You may have seen some tidbits from Drake Star’s report on the state of sports technology/business.

Anyway, I went through the whole thing and want to showcase the key points (along with my thoughts).

Sports Investments Funds

Through the first 6 months of 2023, we’ve seen “sports investment firms” raise ~$6B USD.

Highlighting a few:

- RedBird Capital: $2.3 billion

- Dynasty Equity: $1 billion

- Isos7: $770 million

- Raine Group: $760 million

- Fasanara: $500 million

- Bluestone Equity: $300 million

- Sapphire Ventures: $181 million

- Courtside Ventures: $100 million

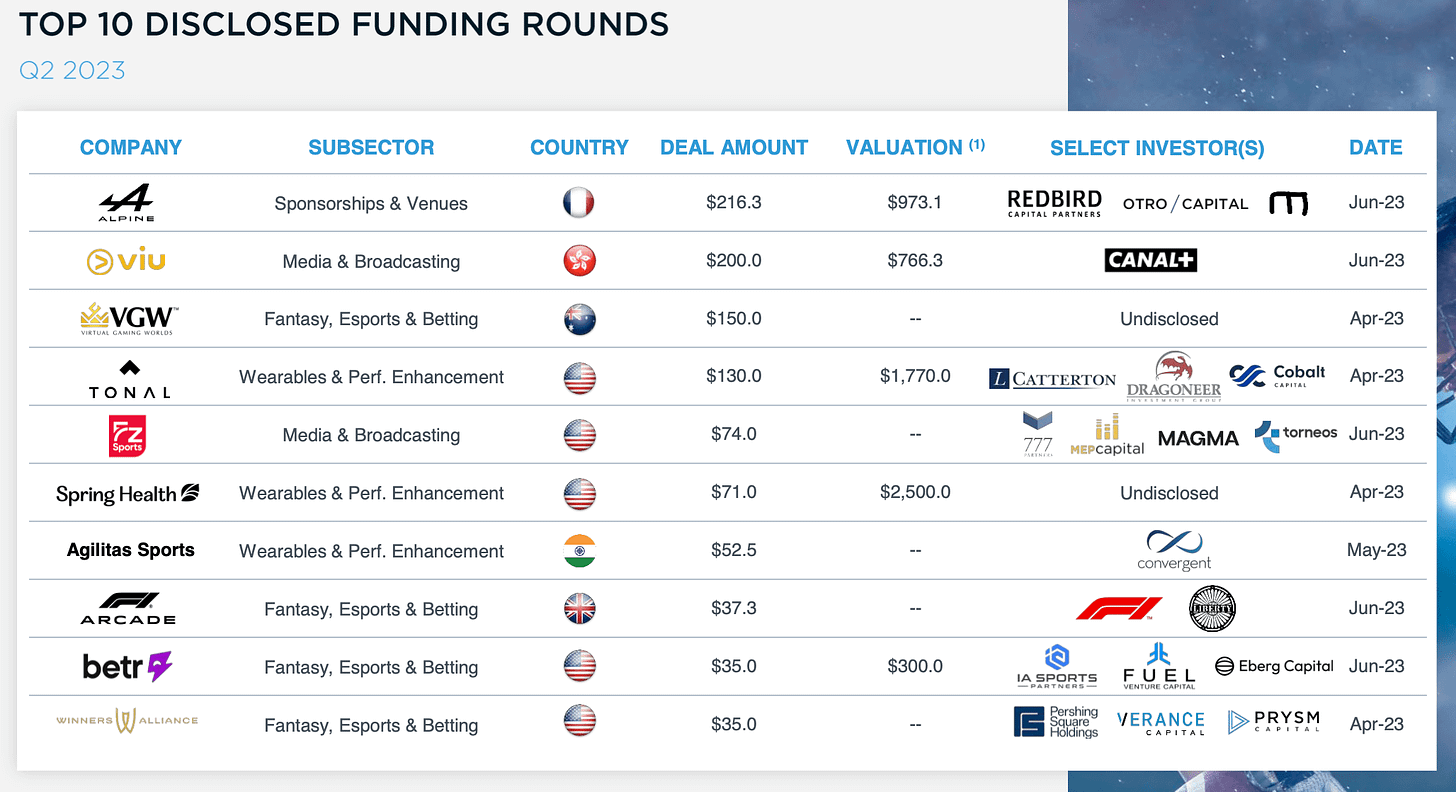

However, compared to prior quarters, the last three months didn’t see a lot of private financing activity (~$1.6 billion).

Drake Star claims 75% of the private investments were for early-stage companies.

We apparently have a different definition of “early-stage” — as I would say it’s flipped with only 25-33% for earlier rounds.

To Note: I follow fundraising closely and have not seen too many pre-seed/seed companies receive funding so far this year (minus this last week 😆)

BTW, venture firms love relative terms like “early-stage” because it allows them to easily disqualify companies in a nice way by saying “You’re too early”.

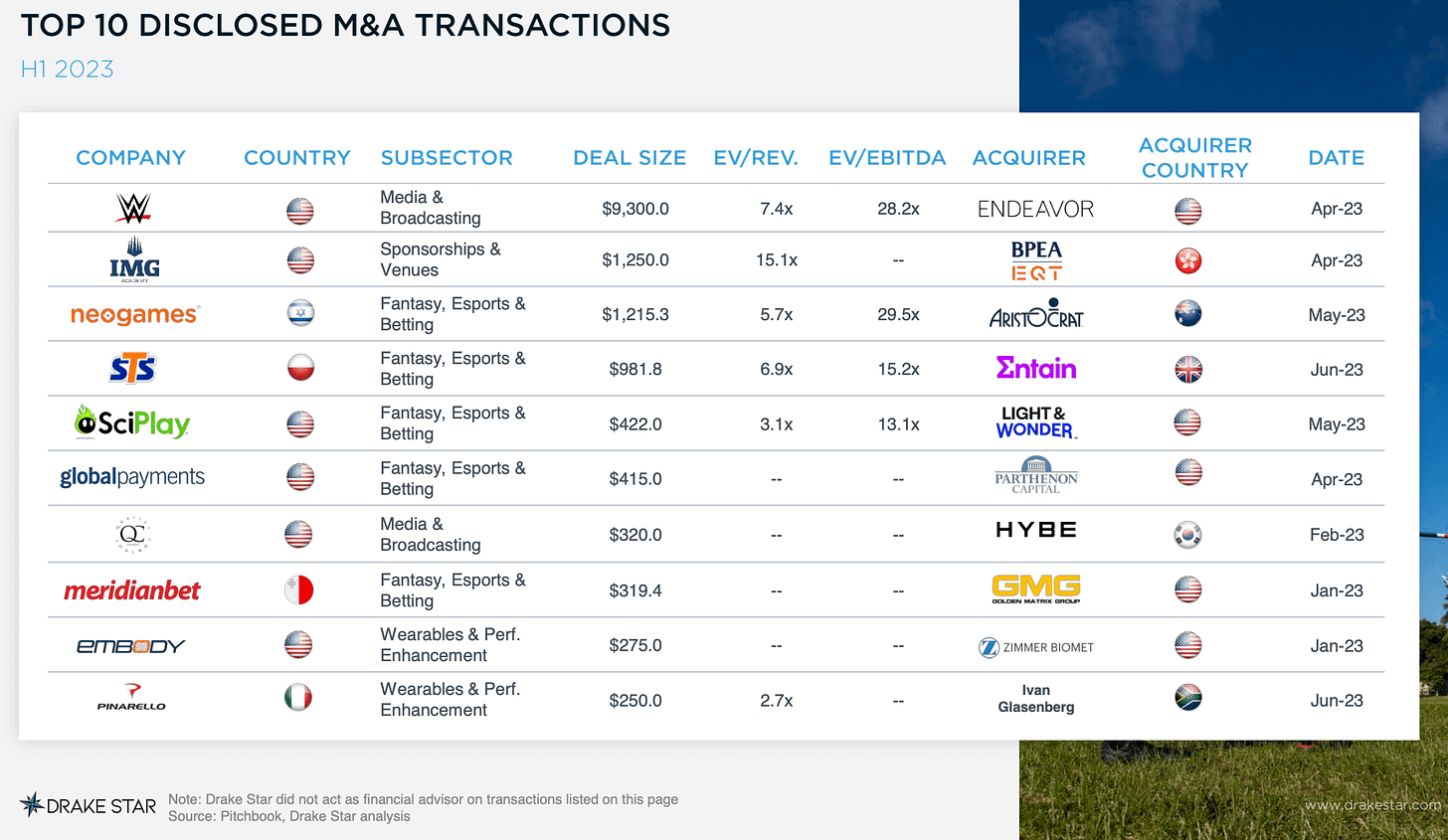

Mergers and Acquisitions (M&As)

It was a big 3 months of M&As with $14.5 billion in deals completed.

Expect M&A to continue increasing…

As you saw above, there is a lot of new capital in the industry looking to be deployed.

I expect organizations like Fanatics, RedBird, PIF-Saudia Arabia, and others to continue making moves (think large roll-ups and a strong flow of mid-size deals).

Public markets are shaky, but I could see sports tech companies like Hudl start exploring IPOs as well.

Sports Tech Market

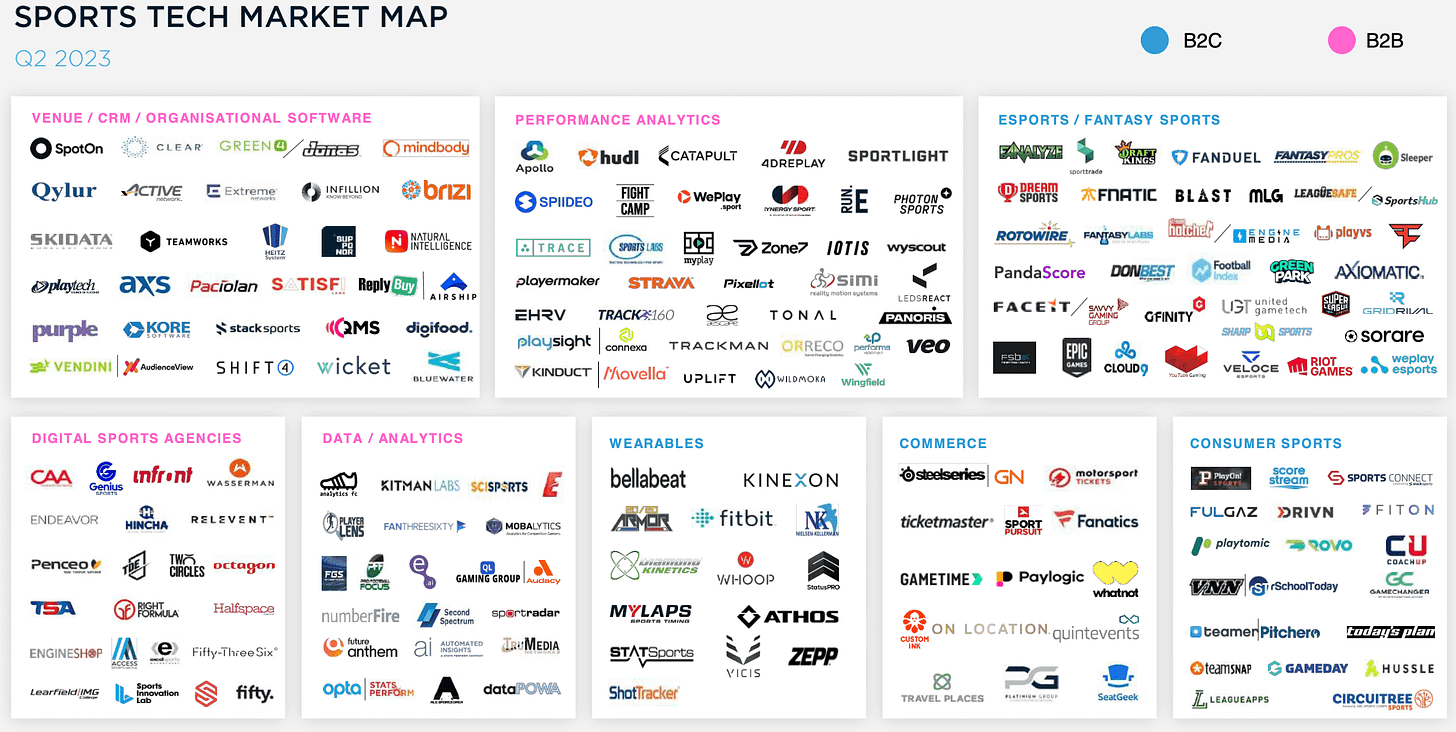

Drake Star also released a market map…

Having created many of these myself — I can say competitive landscape slides are HARD.

This gives a good high-level overview but only focuses on mid-to-late-stage companies.

Stay tuned as I want to keep releasing deeper market maps in unique areas not everyone covers.

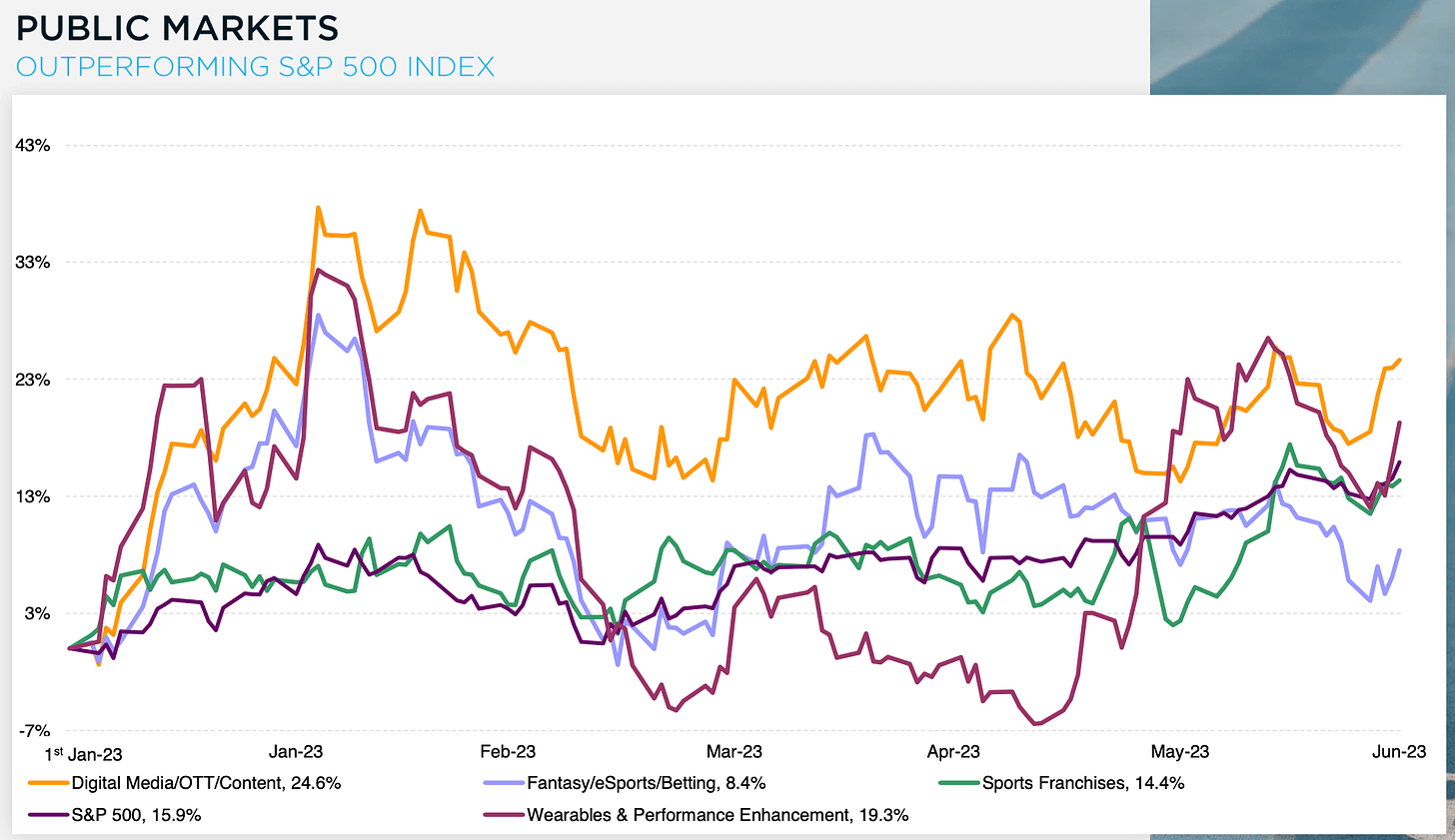

S&P 500 vs. Sports

The sports tech public market continued its strong performance with most of the segments outperforming the S&P index.

Keep in mind…

This is only comparing public sports companies to the S&P 500 (private markets can net even greater returns.)

Examples of public sports companies:

FuboTV, WWE, Manchester United, Peloton, Catapult, DraftKings, Genius Sports, etc.

With M&A set to sweep the space, I expect to see more sports public companies in the future.

Final Thoughts

Drake Star does a solid job so props to them for providing us with their report.

If you look below…

You’ll see I track all of this stuff closely in real time. And not only companies raising money or being acquired, but also what athletes are investing in.

Exciting times in the sports world!