Just like restaurant software can be rolled up…so can sports software.

The case for too small of market sizes is mostly bogus.

Between private equity firms and strategic corporate players, there are now a lot more routes to exit for sports companies.

Today I explore some of the niches around sports (and why the opportunities continue to get larger).

Let’s Dive In 👇

Sports Verbiage

One of the misunderstandings around “sports” is that it is too niche of an industry to generate substantial venture returns.

I believe that’s because people take the word “sports tech” too literally.

There are two ways to look at it:

- true sports tech

- sports as an asset class

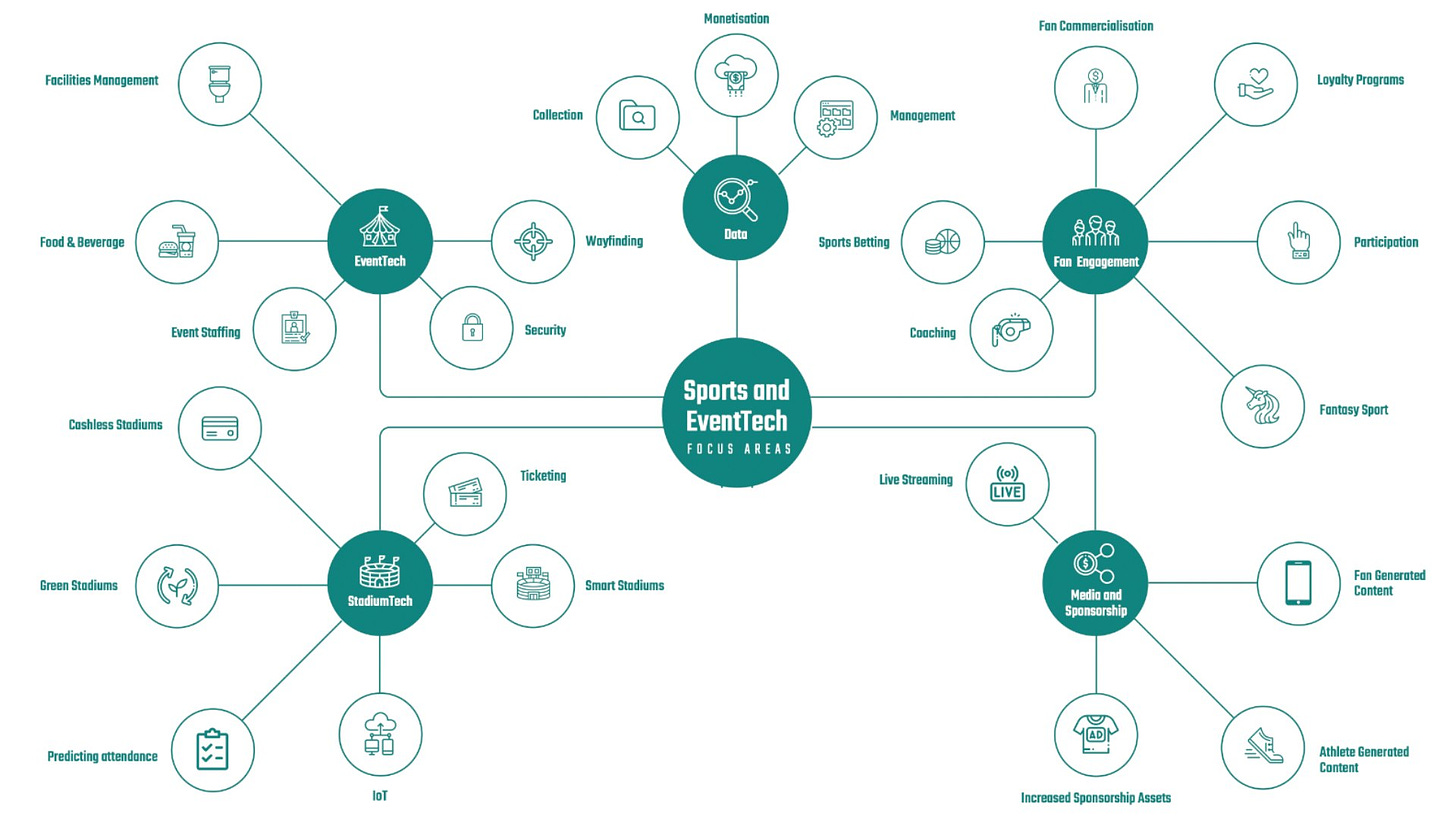

True sports tech looks like this:

Courtside Ventures was the first VC to prove that returns can be made in “true sports tech”…

Their first fund of $35M generated ~$60.3M in proceeds giving them a MOIC / TVPI of ~2.83x / 2.46x respectively.

Sports as an asset class can’t even fit on a chart because you’re also talking about:

- esports

- agencies

- equipment

- health/fitness

- sportainment

- teams/leagues

- documentaries

- and many other verticals

…basically anything that touches sports in some way.

Now that’s an even BIGGER industry! (and where we like to play at Profluence Capital).

And it gets even larger as you start to look horizontally into media, entertainment, culture, and the creator economy.

Let me illustrate my point some more…

Riches in the Niches

Even what are presumed to be smaller niches within sports have led to huge exits for the companies that dominated in market share.

- Sports cameras. Can’t be that big, right? Over 5 companies valued at hundreds of millions of dollars competing for market share globally.

- Racing drones…too small of a sport, right? Nope. Drone Racing League was recently acquired for $250M.

- Team management for amateur sports…multiple big players with huge acquisitions/PE buyouts including TeamSnap and SportsEngine.

- Emerging Leagues. The PFL was born at the peak of the UFC, and in only 6 years has created a product that now rivals it in talent + viewership (and just raised $100M from SRJ investments).

- Automated short-form clips for sports properties…now nearly a $1B company in WSC Sports.

- Tennis ratings can’t be a big market, right? Universal Tennis Ratings (UTR) proved everyone wrong on their 10-year journey to acquisition.

I could go on and on…but you get the point.

So what spurred the idea for this post? The referee industry.

I didn’t know much about it (before the podcast with Refr Sports) but like many niches within “sports tech”…it’s pretty massive.

Check this out…

Referee Niche in Sports

While everyone talks about the referee shortages (which would make sense because parents, coaches, and some kids treat them terribly and turnover is 40%)…

The reality is most referees (refs) are looking for more games.

The stats behind this niche blew my mind:

- 105 million amateur youth sports games/year

- $10-$15 billion in transactions to refs each year

But what I didn’t know is…

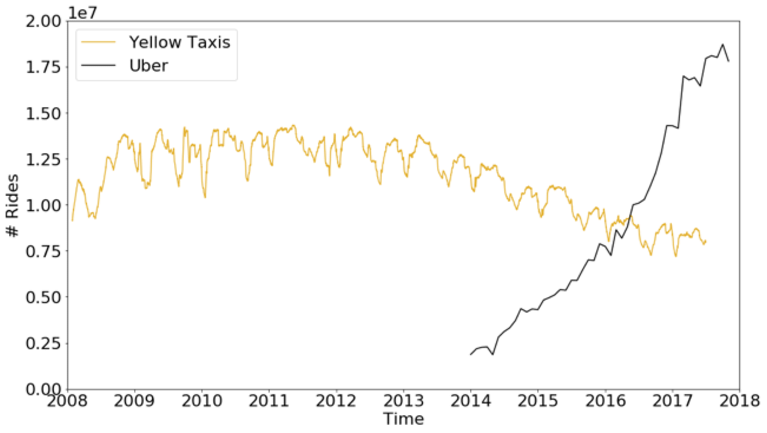

There is something called assigners — very similar to medallions for taxis before Uber disrupted that industry.

There are roughly 50,000-70,000 “ref assigners” across the United States and 20% of the $10-$15B in earnings goes to them each year.

Seems like an opportunity for software to cut out the middleman, right?

A problem exists though…

The barrier to entry for becoming a referee is different for all 30 sports and the training required can be different from county to county.

Some stats worth noting:

- Baseball and basketball ref training is suburb-based, but soccer has a national federation for refs.

- Amateur soccer typically pays refs the lowest at $30-40, while baseball and hockey are the highest (sometimes $90+ for one game).

Super interesting — and this is just one small niche within sports.

*this also shows that to truly navigate sports there is a lot of nuanced understanding required and this is why many non-sports investors make mistakes when trying to deploy into the industry

Looking Ahead

As the outside world starts to treat the industry less like “true sports tech” and more like “sports as an asset class” we’re getting better dynamics:

- Sovereign wealth funds like Saudi Arabia deploying billions.

- Accelerators and innovation labs being created by top sports leagues.

- Private Equity groups being formed to roll up technologies within the major verticals.

- Athletes deploying capital back into the ecosystem.

There’s still a big gap though…

Especially at the early stages and in the middle market — as most of the investor money is concentrated once companies can get to Series A or reach substantial valuation marks.

Where I see a lot of companies get stuck…in the pre-seed to seed stages.

Market dynamics will improve! Exciting times ahead.