The big 4…

- Veo

- Hudl

- Spiideo

- Pixellot

When someone brings up sports technology — these companies are sure to come up in the conversation.

It’s a global race for market domination.

And these sports tech conglomerates armed with sophisticated video cameras are at the center of it.

Let’s Dive In 👇

Starting in a Niche

The sports industry has been fueled by B2B (business-to-business) companies throughout its history.

D2C (direct-to-consumer) is certainly on the rise, as discussed in, D2C in Sports.

But generally speaking, your best chance of building a $100M+ company in sports is through B2B.

And that’s one of the main reasons I’m such a fan of starting in a small niche and expanding from there.

Sports-thematic companies that nailed it:

Gatorade – Florida athletics

Nike – Oregon track and field

Hudl – Nebraska football team

Spiideo – track & field athletes

Under Armour – Maryland football

Why I’m a fan of this approach:

- Work side by side with a partner(s) to create a great product

- Get all the kinks worked out

- Onboard more clients with the success stories

- Create case studies

- Expand to other niches (sports, leagues, geographies, etc)

In theory, success is simple.

And every automated sports camera company started in a niche, won it, and then expanded to more.

Hardware is Tough

If you have any experience with hardware, you’ll know how hard of a business operation it is.

Which is why software is the golden ticket.

Easier to sell, scale, and have acquired.

Almost all of these sports video providers focused on the software first and then figured out the hardware later (which resulted in higher margins through upsells).

And with AI getting better day by day, many of the outsourced manual tasks (such as keeping player stats) are becoming automated.

The Big 4 companies are all valued in the $100s of millions — and the winners in this race are certain to become unicorns.

Let’s break them down:

The Big 4 in Sports Video Cameras

As you’ll see from the recent fundraises — the race is on.

Veo

🇩🇰 Denmark

📍 Founded in 2015

💵 Raised a $78.4M Series C in 2022

Developed a portable AI video camera allowing players and parents to set it up at their games.

Veo came into creation after their co-founder was late for his son’s football game and wondered why all games (even youth) weren’t recorded.

Pixellot

🇮🇱 Israel

📍 Founded in 2013

💵 Raised a $161M Series D in 2022

Developed broadcast video capture designed to provide an affordable alternative for live coverage of events.

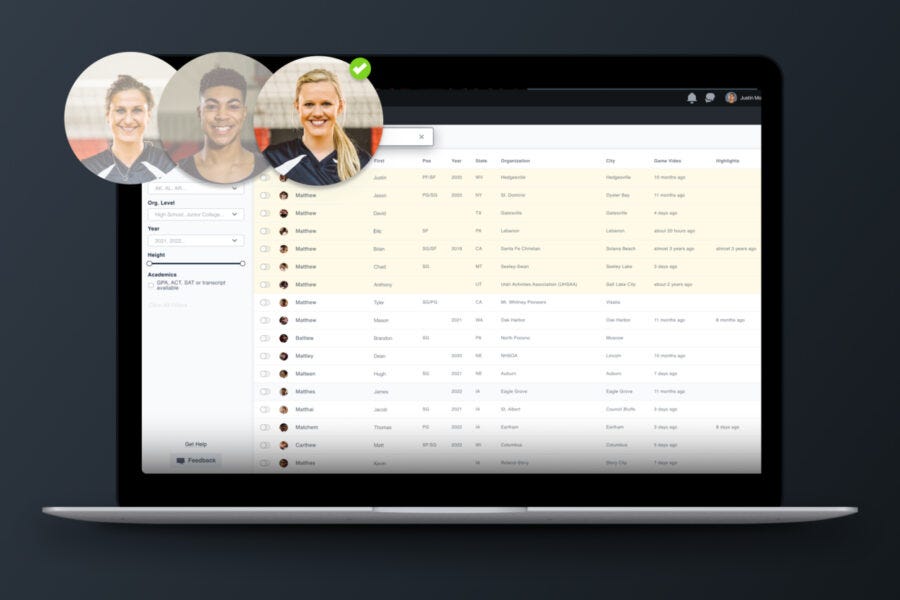

Hudl

🇺🇸 United States

📍 Founded in 2006

💵 Raised a $120M Series F in 2020

Created at the University of Nebraska as a sports performance analysis software intended to study and improve athlete performance through insights with video and data.

Over the last few years, they’ve jumped into the AI video camera race (and have made several acquisitions).

Spiideo

🇸🇪 Sweden

📍 Founded in 2012

💵 Raised a significant Series B in 2020

Developed a sports video camera application designed to make advanced sports video recording easy, useful, and accessible.

Started in track & field + swimming but have expanded to 8+ sports (have a large market share in soccer).

Breaking it Down

I want to take a look at some of the main differences between these companies.

A few things to note:

1. I’ll be simplifying this greatly

2. I’m using Spiideo as the main comparison based on the conversations I had with their CEO, VP of Marketing, and Head of Sales

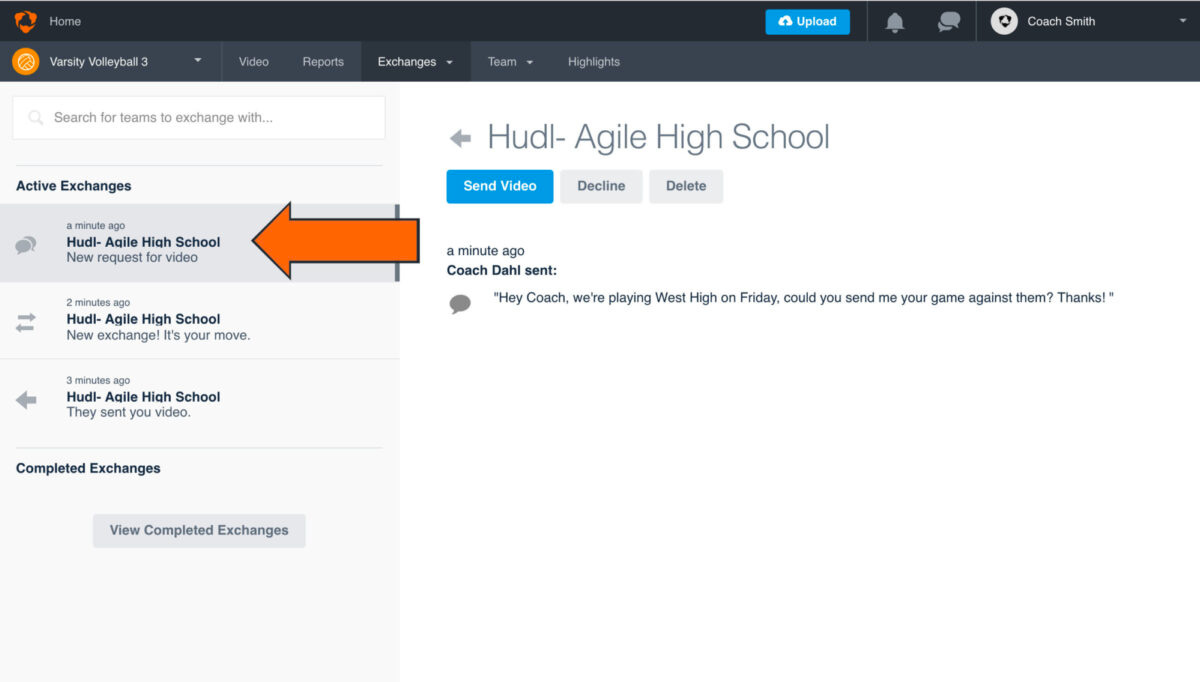

League Exchange

One day I’ll write a whole piece on the league exchange and just how powerful it is but here’s a nice summary.

Moat – distinct advantage a company has over its competitors that allows it to protect its market share and profitability (defensive tactic)

Competitive Advantage – anything that gives a company an edge over its competitors, helping it attract more customers and grow its market share (offensive tactic)

Hudl created both in the high school football and basketball landscape through their league exchange which was created about a decade ago.

An example of how it works…

During my freshman year of high school (2013-2014), teams would have to send assistant coaches to games to scout.

By my junior year, all WPIAL teams were required to film the games and upload them to Hudl.

This was both a “moat” and “competitive advantage” — as it kept competitors out and exploded the adoption of Hudl.

But there’s still so much of the market to go after…

This is what Spiideo has done in collegiate soccer (60% market share) and what other big 4 members are capitalizing on as well.

If you get league adoption, then you also get team adoption.

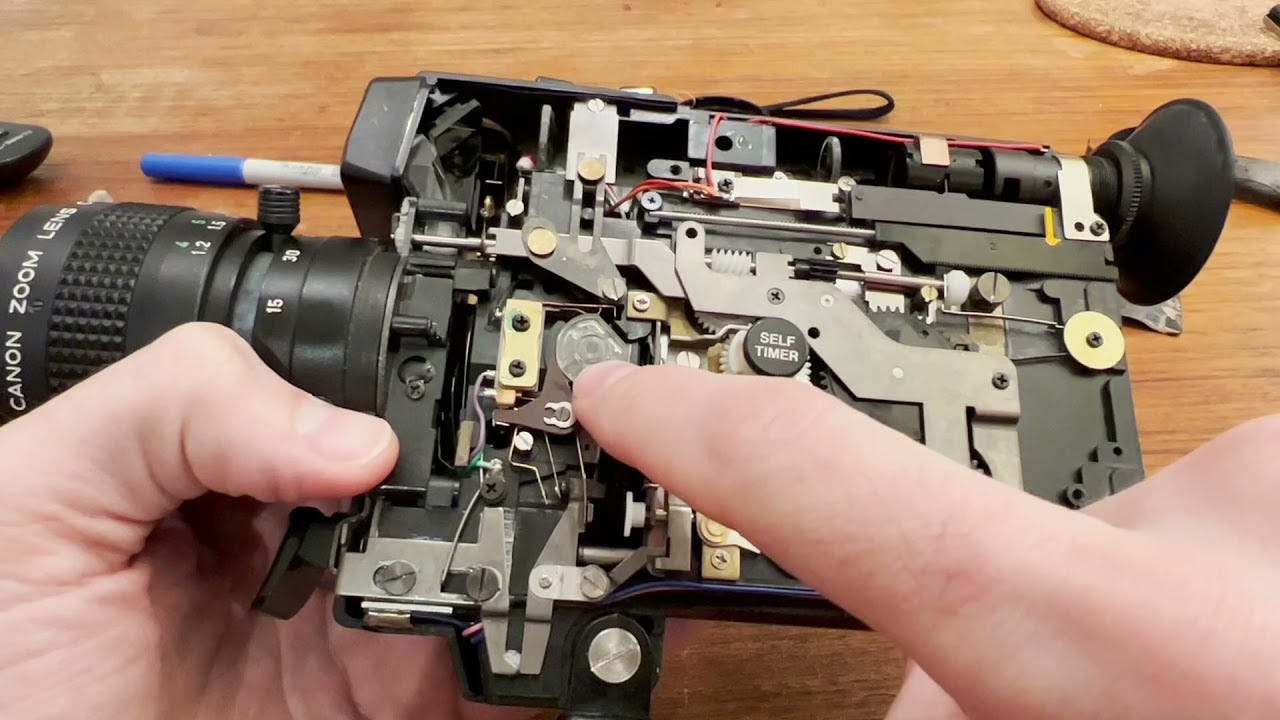

Camera + Software Tech

The camera topic is interesting for an array of reasons…

Some companies started with cameras, but most started with software.

And as the sports ecosystem caught up, having all of these features became a necessity.

How these companies got started is interesting…

- Hudl as software and analysis tools.

- Pixellot streaming and broadcasting for youth sports.

- Veo portable smart cameras for youth sports parents/athletes.

- Spiideo began as a video capture solution for athletes and then quickly after clubs.

When looking deeper at Spiideo…

They decided to outsource their cameras to Axis — which is one of the largest camera manufacturers in the world (also from Sweden).

Most of the other companies try to build them in-house and also use local servers.

Spiideo has been cloud native from day 1 which has an array of benefits:

- live video

- no servers necessary

- uploads right when done

- allows Spiideo to scale and deploy updates remotely

- no longer dependent on waiting for other teams to upload

At the end of the day…

Coaches want analysis.

Schools/Clubs/Media Companies want automatic production.

Athletes/Parents want analysis + automatic production.

Spiideo has even programmed their AI to be sport specific and released instant replay.

Other cool features they have:

- capture individual breakdowns even if practice splits into 6 groups

- stats and game info pops up into the screen automatically during a broadcast

- ability to capture, tag, draw, share, collab, and send video to other softwares

Forward-thinking youth clubs and AAU organizations are already adopting this type of technology.

My Thoughts on The Big 4

Hudl has long dominated the North American market (especially football and basketball) but has some catching up on the actual hardware.

They also scaled a little too slow leaving gaps for all these other companies to emerge.

Never doubt Israeli sports tech, which is what Pixellot is.

Veo has a unique D2C model selling directly to athletes/parents, but with others rolling that out and not many B2B accounts they’ll need to get creative.

Spiideo has the best product on the market and the most potential in my opinion.

With the World Cup coming to North America in three years and over 90% market share in NA professional leagues Spiideo has that in their favor.

Ultimately, there’s room for 3 major players in this massive market which is AI automated sports cameras.

Impact on Youth Sports

There are thousands of kids around the world that should be thankful these video provider companies exist.

Without them, many kids would go unnoticed and slips through the cracks during the recruiting process.

One thing I am interested to watch…

Is how these video platforms add D2C products to their empires.

Veo is doing it with the actual cameras…

But what about recruiting, NIL, and training tools which can all be extensions of these video companies?

And the massive opportunity (as you’ll hear Patrik say in the podcast) is in the middle of the pyramid.

What do I mean by that?

In making high-level sports broadcasts, analysis, and engagement for not just pro sports — but also youth sports.

Fun times lie ahead as these sports tech giants battle for market share (which will drastically improve innovation across the space).