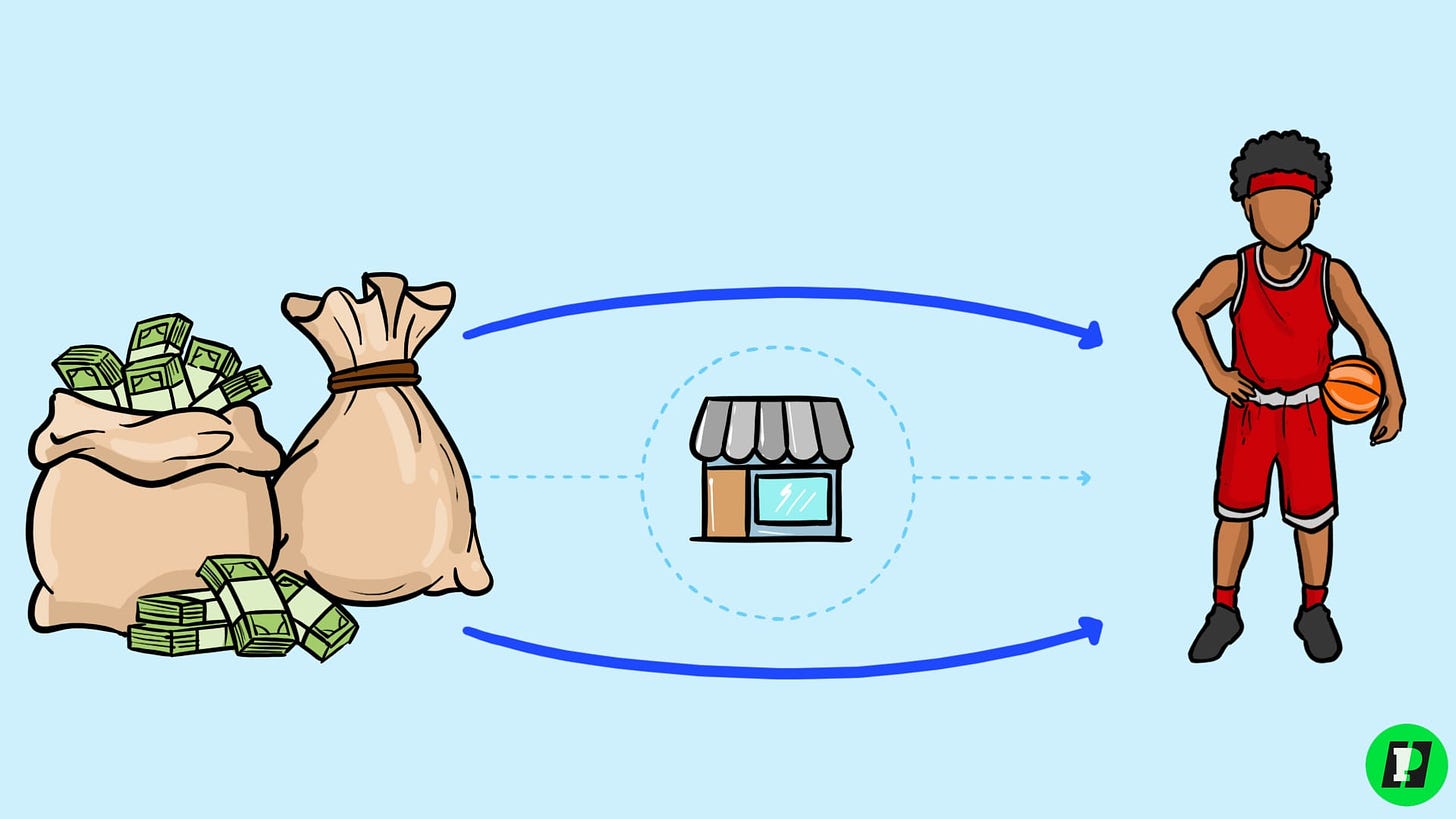

2022 was the year of marketplaces — where platforms connect the main players in sports together.

In 2023, we’ll see more of an emphasis on D2C.

What’s D2C?

Direct to consumer.

A direct-to-consumer business sells its own product directly to its end customers, without the help of third-party wholesalers or retailers.

In sports, this is about removing the middlemen.

Straight from ____ to the athlete, company, team, organization, etc…

Let’s Dive In 👇

D2C in Sports

There’s only one thing you have to understand before I lay the groundwork…

There will ALWAYS be middlemen in sports (very few entities are going to manage everything on their own).

However…

Software is helping to remove the unnecessary hands at the table, reduce the time deals take, and are making it easier for athletes + their teams around them.

Here’s where D2C is going in 2023:

Private Funding

Big League Advance is currently seeking $250M for its operation where it funds minor league baseball players.

The investment firm uses a simple D2C concept…

They pay MiLB players an upfront payment in exchange for a % of their future MLB earnings.

- Example: $350,000 payment — 8% of future earnings.

In total, they’ve raised over $150M and have invested in hundreds of minor league baseball players.

I think we’ll continue to see this D2C funding model play out for ALL sports in the private market (including even possibly college).

It is also extending to the public as well…

Over the past few years, we’ve seen the rise of “stock market platforms”.

These enable fans to fund athletes directly — and own some of the upside potential in their careers).

Sports team owners invest in a player’s career, it’s only a matter of time before the public has that ability as well.

Endorsements

Look at the FTX debacle.

Steph Curry, Tom Brady, Shohei Ohtani, and Shaq all received negative publicity for taking money from a fraudulent crypto company.

In today’s fragile society, where trust takes years to gain but only one day to lose — I think endorsements are changing.

And with athletes making so much money from salaries, it’s smarter to monetize directly from their followers or with their fans.

Endorsements will slow down and partnerships will become the norm.

What do I mean by partnerships?

Real business relationships that extend beyond just putting up a picture on Instagram or doing a photo shoot.

We’re talking about really getting behind brands — like equity and relationship building (on top of the endorsement money).

By going D2C, athletes have more of the upside — instead of just being an intermediary for brands to capitalize on their followers.

NIL

And this same model shifts down to college athletes as well.

It’s extremely time-consuming to do endorsements when you already have class, study hall, traveling, and your sport to worry about.

Platforms that reduce this friction will rise.

And we’re certain to see platforms that entirely skip anyone even knowing if an athlete did a deal with a brand.

Platforms that garner brands access to the athlete/team/organization followers.

And at the end of the day…

That’s what brands really want right?

To reach the most amount of people in their ideal audience.

Investing

Companies aren’t the only ones who want DIRECT access to athletes.

Investment firms want notable athletes as limited partners (LPs) and sometimes even general partners (GPs).

But even that creates a middlemen scenario.

Which is why…

Many athletes are starting their own investment funds (going directly to companies for funding instead of through a third-party VC).

Why are they doing this?

Trust, notoriety, and more upside.

One Downside I Forsee…

With athletes wanting the D2C route — there are some potential downfalls.

In the past, we were worried about athletes making bad investments…

In the future, we’ll be more worried about athletes starting “bad” companies or losing their reputations by attempting to tackle an idea on their own.

Jake Paul is a current example of this (although it’s working out great so far).

Stake offered him millions to endorse their micro-betting company — instead he started, Betr, his own brand which is nearly identical to Stake.

D2C — it’s the name of the game in the creator economy.

Quick pointer for founders…

It’s great to have athletes on the cap table — but you should also know which ones aren’t afraid to start companies themselves.

Going Forward

I anticipate we’ll see a BIG direct-to-consumer (D2C) push in 2023.

Instead of athletes allowing brands to garner all of the upside from their audience, they’ll sell directly to their followers through ownership of products, services, and portfolio companies.

Many platforms are being built to enable this direct form of monetization (and will continue to be).

Speaking of D2C…

My guest on this week’s podcast, Nick Esayian, dropped some gems about how D2C is impacting the sports equipment space (like how companies such as Nike and Dick’s Sporting Goods are using data to remove middlemen and sell directly to their end customers).