Sports have been around forever, yet their appeal to investors is only now starting to catch on.

Two major reasons:

- The rise of media made them global.

- The rise of social media made them personal.

Today we’ll explore the evolution of sports as an asset class. 👇

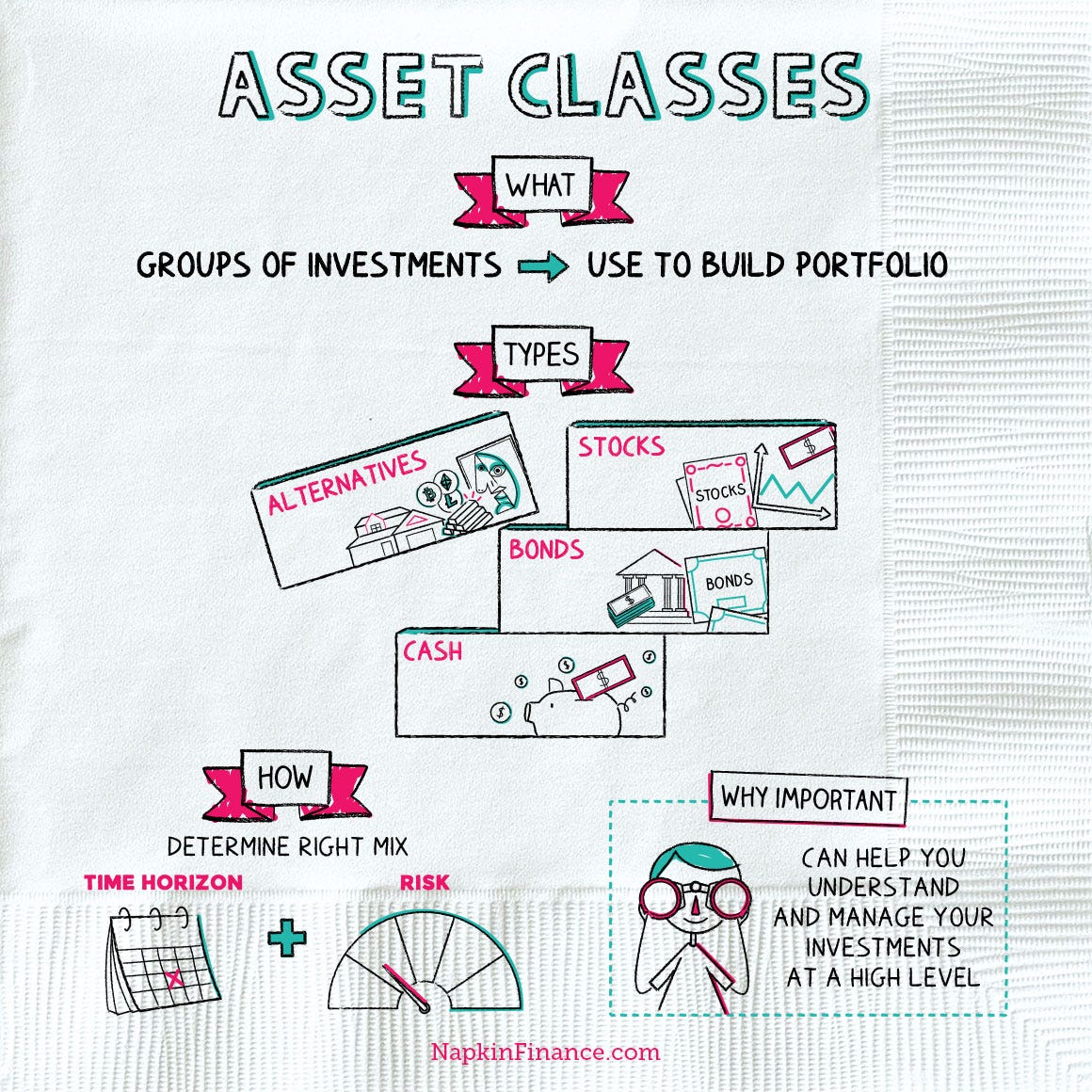

Sports As An Asset Class

In finance, an asset class refers to a group of investments that share similar characteristics and behave in a comparable way within the market.

Traditional asset classes include:

- cash

- stocks

- bonds

- real estate

- commodities

However, in recent years, alternative asset classes have gained popularity due to their unique investment potential.

Historically, sports have been viewed purely as entertainment and a cultural phenomenon.

But it’s changing…

The rising commercialization of sports (and the development of various revenue streams) have transformed the industry into an attractive investment avenue.

With traditional markets becoming increasingly volatile and saturated — investors are seeking new and non-correlated opportunities, making sports an appealing choice.

Why Now?

In the beginning, sports faced skepticism from traditional investors who questioned its:

- profitability

- ethical implications

- long-term sustainability

- ability to expand beyond the niche

So what changed?

A bunch of things — both within sports and from a macroeconomic perspective.

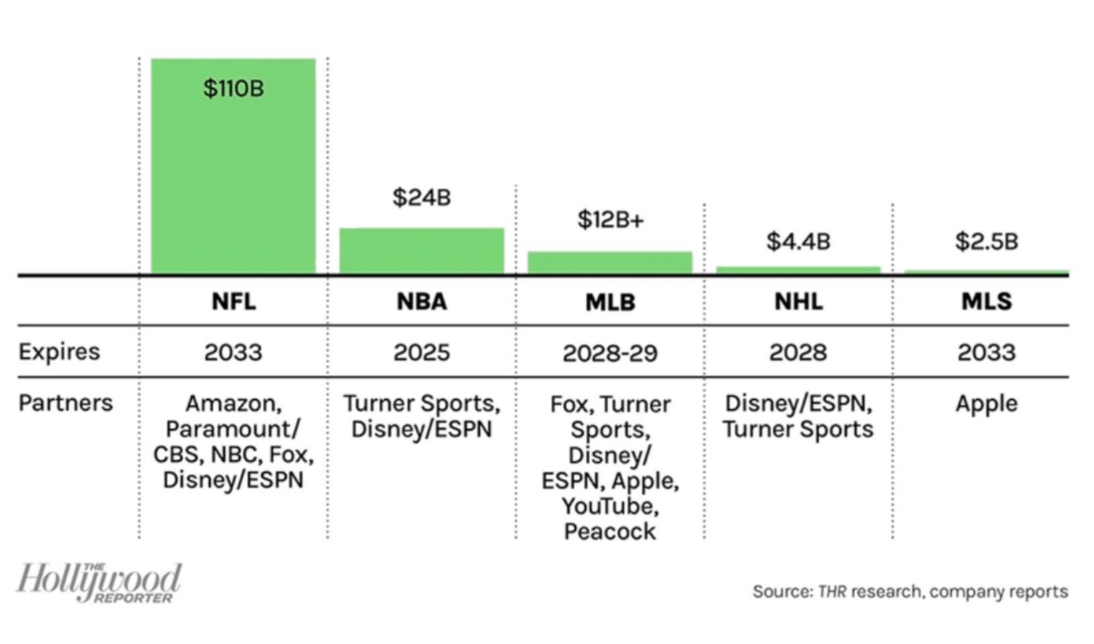

Most of it boiled down to the establishment of major sports leagues and the expansion of broadcasting rights (which paved the way for commercialization across other verticals).

Factors Driving Sports as an Asset Class

Sports have a unique ability to transcend borders and cultures, creating a vast global fan base.

Why does this matter?

Competition for broadcasting rights has driven up the value of media deals (which provide stable and significant revenue streams for leagues and teams).

In the early 2000s, you could only watch sports on a handful of cable channels.

- ESPN

- NBC

- FOX

- CBS

- NBC

Today, the viewing options are unlimited:

Sport media brings eyeballs — which in turn offers a platform for brands to reach a large and engaged audience.

Sponsorship/endorsement deals with athletes and teams have become a lucrative source of income, attracting investors looking to capitalize on this revenue potential.

These factors opened up more avenues…

Including various ancillary markets — sports merchandising, technology, betting, esports, etc.

Rise of Betting & Fantasy Sports

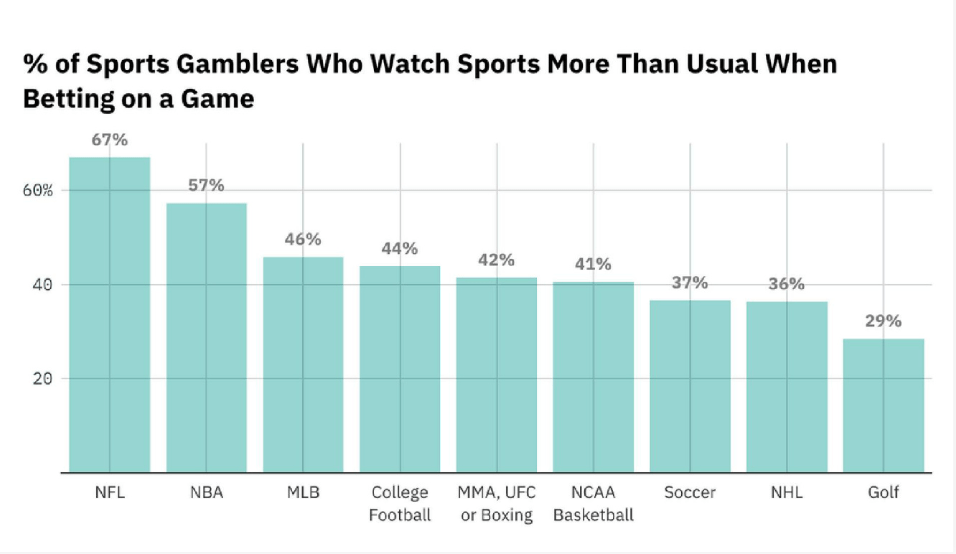

The emergence of fantasy sports has engaged fans on a new level, turning them into virtual team managers.

It’s also increased the amount of sports watched by fans (and overall viewing time).

Women’s sports have seen significant growth thanks partly to legalized mobile sports betting.

Even more wild…

The 3 biggest U.S. sports betting markets (Texas, California, and Florida) are still not live and active.

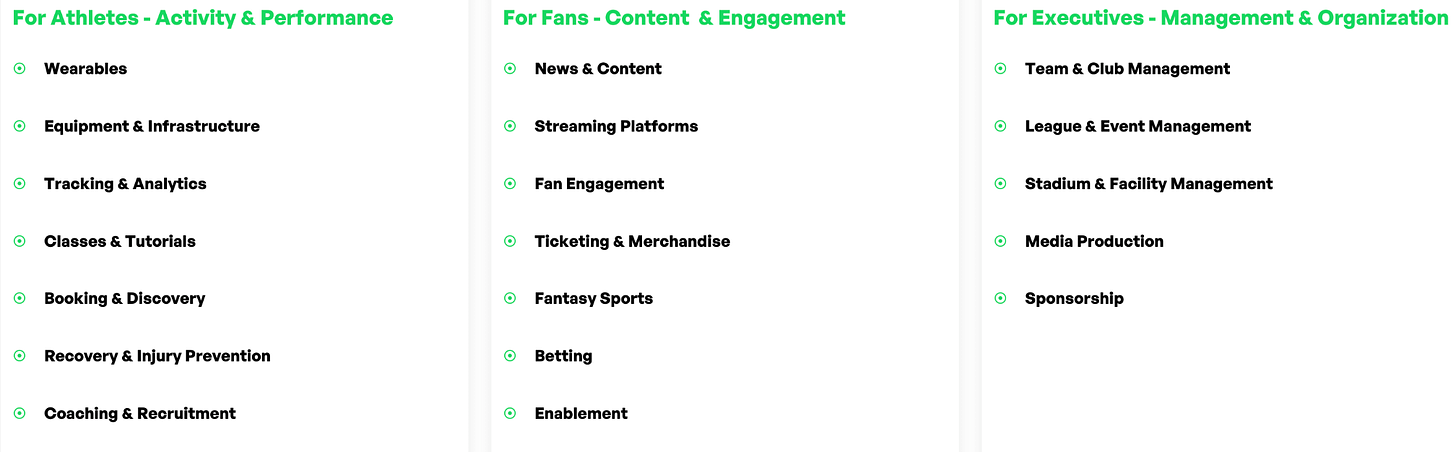

The Emergence of Sports Technology

Advancements in sports tech such as data analytics, performance tracking, and fan engagement platforms have opened up new avenues for investors.

But it doesn’t stop there…

Sports technology companies are often testing their product-market fit in sports and expanding to other industries.

WHOOP started as a wearable for athletes to track sleep and heart rate — it’s now a $3.6B global company.

So what’s next?

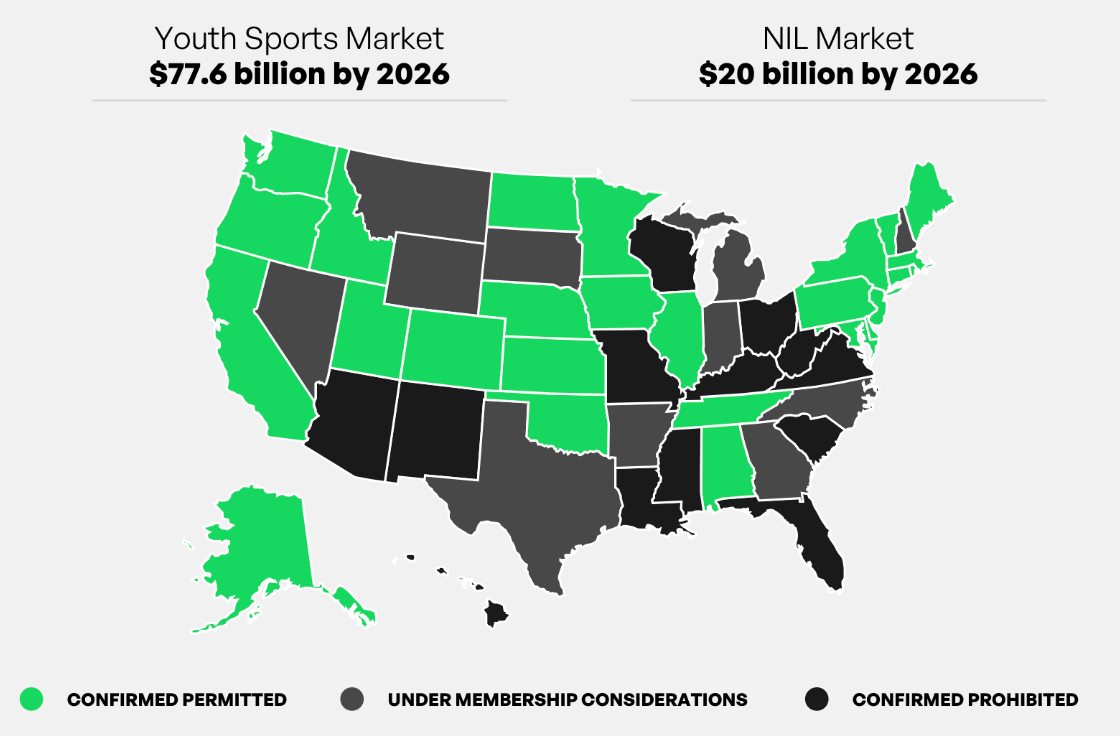

All of these improvements are headed downstream. Name, Image, and Likeness (NIL) will commercialize all of sports!

A little over half of the states allow high school athletes to make money (but many are still very restrictive in their ways).

Institutional Investors Enter Sports

The world of solo ownership by billionaires is slowly starting to fade.

Institutional investors, including private equity firms and hedge funds, are increasingly exploring opportunities in the sports industry.

But it wasn’t always this way…

In 2019, Major League Baseball (MLB) became the first US professional sports league to allow private investment funds to hold passive, minority interests in multiple teams.

Most other leagues followed suit not long after (NBA, NHL, and MLS).

Sovereign wealth funds, particularly Saudi Arabia through PIF, are now exploring opportunities in sports.

Diversification Benefits

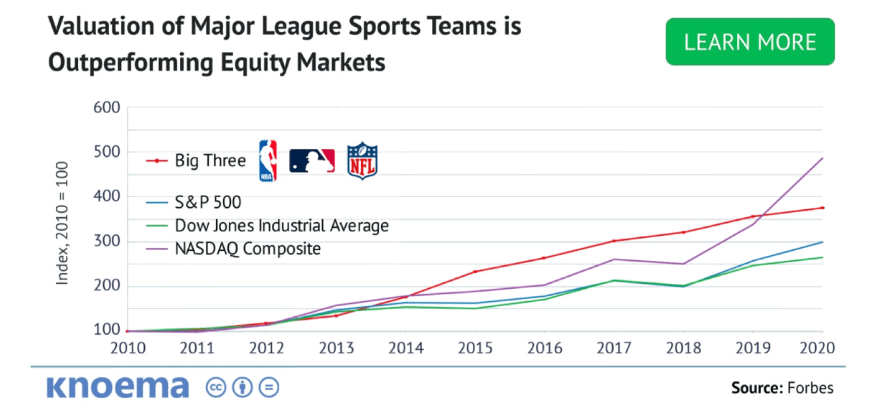

Sports investments often exhibit a low correlation with traditional asset classes like stocks and bonds (this helps diversify investment portfolios, reducing overall risk).

During economic downturns, consumer spending may decline, but sports have shown resilience as people continue to seek entertainment and distraction.

This stability makes sports an attractive hedge against economic uncertainties.

As I touched on in “Sports: The Recession-Proof Industry”, even tough times like a global pandemic didn’t halt the growth.

For investors looking to diversify their portfolios, sports provide an opportunity to allocate funds into a non-traditional asset class that can potentially deliver solid returns.

Future Outlook: Sports As An Asset Class

Sports investments offer a unique combination of financial potential, entertainment value, and diversification benefits, making them an attractive asset class for both seasoned and emerging investors.

The one thing I will say…

It’s hard for the average investor to understand the complexities of sports.

On top of that…

Individual investors often face liquidity constraints and have a hard time gaining access to the best (and most exclusive deals).

If you’re interested in adding “sports” to your portfolio then shoot us an email at [email protected].

We have some interesting investment opportunities for accredited investors.