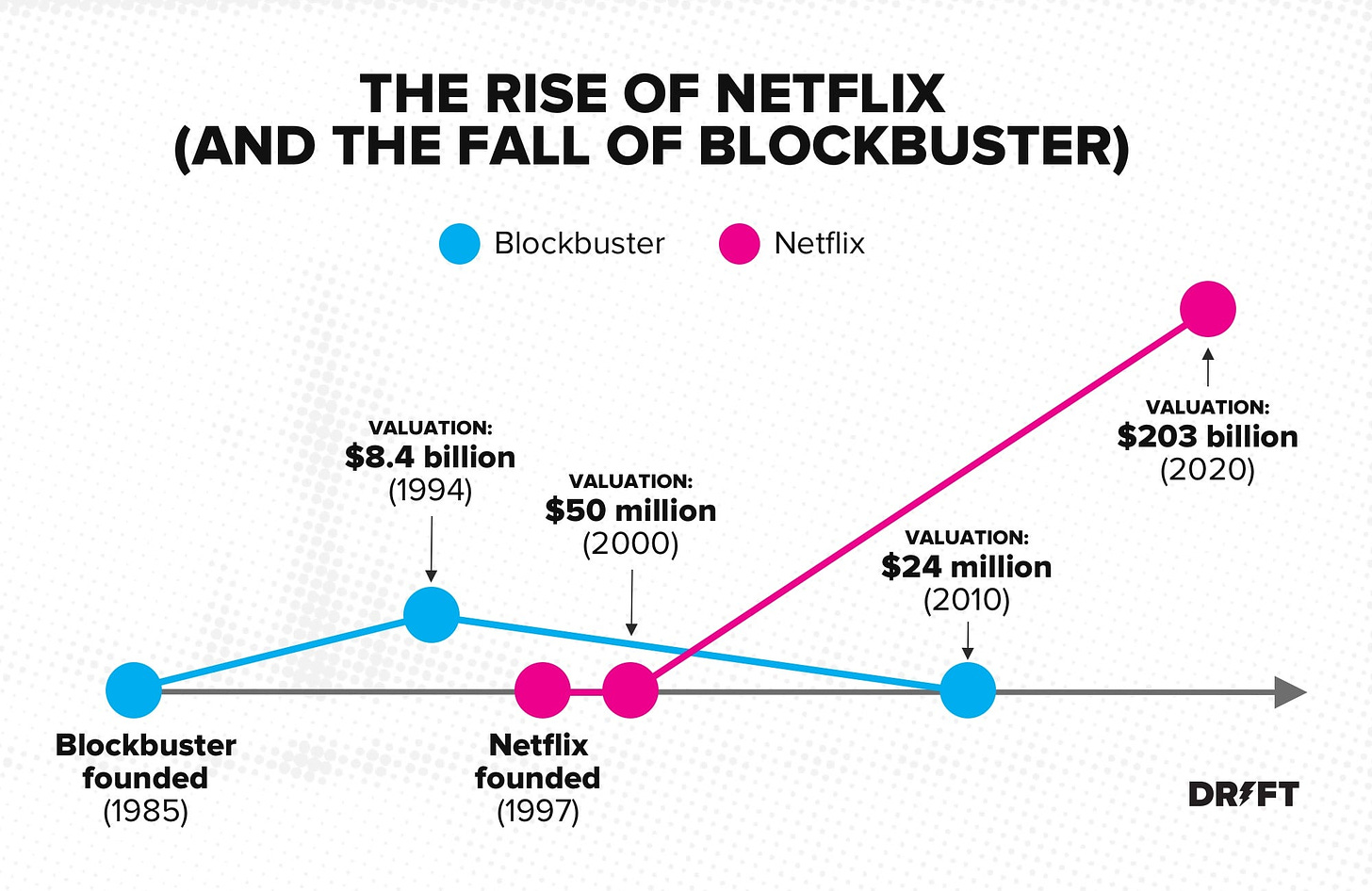

“Pioneers get slaughtered, and the settlers prosper.” – Daymond John

Pioneers, in a business sense, represent the people with a new idea for an app, service, or industry — metaphorically these companies get slaughtered.

It’s the settlers that actually prosper because all the mysterious dangers & mistakes have already been identified (and the road before them is clear).

There are lots of examples of this:

- Google / Yahoo

- Facebook / MySpace

- Netflix / Blockbuster

The original creator of the product or service gets skewered, either due to not seeing future trends or acting prematurely on decisions that in hindsight look questionable.

Why start with this quote?

In my opinion, this is how the sports ecosystem is currently playing out.

Let me explain 👇

The State of Sports Business

We’re starting to see a lot of pioneers metaphorically getting slaughtered in the sports ecosystem.

And the settlers are starting to move in.

Let’s explore this throughout the main trends in Q1.

NIL / College Sports

NIL is coming off a strong Q1 — particularly in the women’s basketball space.

Caitlin Clark and Angel Reese have cemented themselves in history.

They also showed that talent + personality can work (defeating the claim that “only sexualization will work”).

As I predicted a year ago, NIL marketplaces are in a heavy consolidation phase (with many of them altering their business models).

The basis of this…

Big companies go directly to the agents of the star athletes — there are not enough transaction fees for just Olympic sports players.

On the University side:

Donors aren’t good for consistent year-over-year money and schools/3rd parties are starting to turn to the brands.

Indiana University launched a venture arm — which is the first of its kind.

Web3

Not much action in Web3 x Sports so far in 2023.

However, I will say that the true builders are continuing to innovate behind the scenes.

On my recent podcast, NFL Players Inc president Steve Scebelo said that the “metaverse” will have its day in sports (but is a few years out).

NFTs in terms of artwork make zero sense, but NFTs in terms of “gated access” and “community building” are the future.

McLaren F1 proved this when they sold over 330,000 collectibles a month ago.

DAOs were quiet for a long time — until LinksDAO finally bought a Scottish golf course for $900,000.

Fan Engagement

Everyone is still trying to figure out fan engagement.

There is yet to be an app that nails it down (although I’m seeing a bunch of early-stage companies with promising ideas).

The problem is that social media — Twitter, Facebook, Instagram, TikTok, and Reddit garner most of the attention in sports.

Acquiring new customers gets expensive (and retaining them is even harder).

Women’s Sports

We saw brands like Ally Financial and Canadian Tire commit large parts of their sponsorship dollars to women’s sports.

The Women’s Tennis Association (WTA) received a $150M investment.

NCAAW Final Four broke records (9.9M viewers) and showed how entertaining “sports” can be. It also reinforced the fact that fans follow players first (and then teams).

Atlanta Hawks launched a $50M women’s fund and The Monarch Collective formed a $100M venture fund targeting teams and leagues in women’s sports.

With looming media contracts and more committed sponsorship dollars — women’s sports teams are looking more promising day by day.

Media

New leagues are being formed on the basis of winning short-form content followers first (and then exploring traditional media rights deals later).

With so much content for these streaming companies to fill — new leagues are betting on the premise that someone will pick up their rights.

A TikTok ban would be very damaging to the ecosystem (I think it’s unlikely).

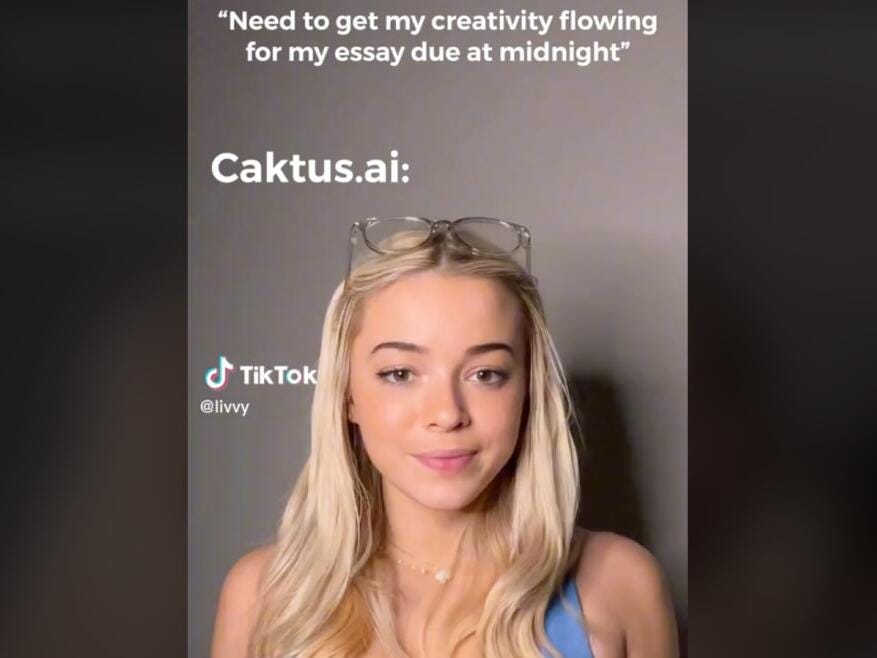

Artificial Intelligence

AI is the hot buzz right now…

Tons of companies are now raising capital on the basis of artificial intelligence.

We had several prominent college athletes promote Caktus AI which raised ethical concerns.

I’m interested to see how AI helps ease the process of sports verticals like commentary, game notes, and backend management.

Leagues

New leagues are popping up everywhere.

We even have old defunct leagues taking another shot at it:

- Slamball is back after $11M Series A

- Major League Table Tennis is launching in 2024

- USBL looks like it might be coming back after a SPAC merger

Pickleball is continuing to put up impressive numbers (a recent APP report estimates 48 million US adults have played pickleball in the last 12 months).

Several teams/leagues even launched their own accelerators/incubators (including the MLS, FC Barcelona, and the Orlando Magic).

Funding

Q1 of 2023 saw over $1 billion in new capital heading toward sports-centric investment funds.

Fundraising is still extremely tough — especially for early-stage companies.

Most of the companies getting capital in the current climate have two things in common:

- talented + experienced team with deep relationships

- growth in revenue, without CAC drastically going up

Athlete Space

Terance Mann recently invested and joined Slate Milk as an ambassador (he did this deal via DraftDay Capital).

But we’re seeing entertainers pull off a new playbook…

Celebrity buys an existing brand, then uses their following to bring the brand to a new level.

- Ryan Reynolds did it with Mint Mobile & sold it for $1.35B last month.

- Jack Harlow just did it this week, buying Phocus, a brand of caffeinated sparkling water.

In a world of CAC headwinds, leveraging built-in distribution is an interesting playbook.

Only a matter of time before athletes start doing this.

2023 & Beyond

Here’s an outlook for the sports tech industry:

1. Continued consolidation and investment

The sports tech market is expected to experience strong consolidation and a significant flow of investment in 2023.

2. M&A activity:

Large strategic players like Entain, Fanatics, Flutter, DAZN, and Sony are expected to continue looking for acquisitions.

PE-backed platforms such as Kore, TGI, and Hudl will likely continue their buy-and-build strategy (seeking synergistic targets).

3. Large roll-ups:

With PE funds like Ares Management and RedBird raising substantial new funds — large roll-ups are anticipated in 2023.

4. Hot segments for M&A and financing:

Fan engagement, AI, ticketing, and venue management are predicted to be popular areas for M&A and financing activity.

This is especially true as innovation starts to seep its way downstream to youth sports.

5. Strong inflow of investments:

Over $1 billion of new capital was raised in just Q1 of 2023.

Valuations have dropped and investors might be more cautious — but with so much fresh funding now is a GREAT time to start a sports company.

6. IPO/SPAC listings:

After a quiet 2022, the market and valuations for public companies are expected to recover in the second half of 2023.

IPO-ready sports tech companies may explore IPO/SPAC listings.

Exciting times are ahead 🥂