It’s July 2013, I get back from baseball practice and want to watch the Pittsburgh Pirates take on the Chicago Cubs.

Where do I go to watch the game?

Channel 43 – Root Sports.

A decade later, the landscape is entirely different (mostly due to the decline of Regional Sports Networks).

Let’s Dive In 👇

Regional Sports Networks

The first regional sports network launched in 1969 (a 125-game deal for the New York Knicks and Rangers).

So what’s the purpose of them?

Regional Sports Networks (RSNs) are sports-oriented TV channels dedicated to a local market or geographic area.

By the 1990s, RSNs exploded onto the sports scene and hit their peak in 2010 (when more than 100 million households had a cable connection).

It’s been all downhill since — mostly due to cord-cutting and younger generations never connecting to the bundle.

And it’s not getting any better…

Most cable, satellite, and even live TV streaming services offer RSNs, but not every RSN is available through every TV provider.

For example:

- FuboTV offers a variety of RSNs, but that assortment won’t matter if none of the RSNs are available to your region.

- Hulu, YouTube, and Sling TV don’t carry popular RSN groups like AT&T SportsNet and Bally Sports.

But there are bigger problems to worry about in the near future…

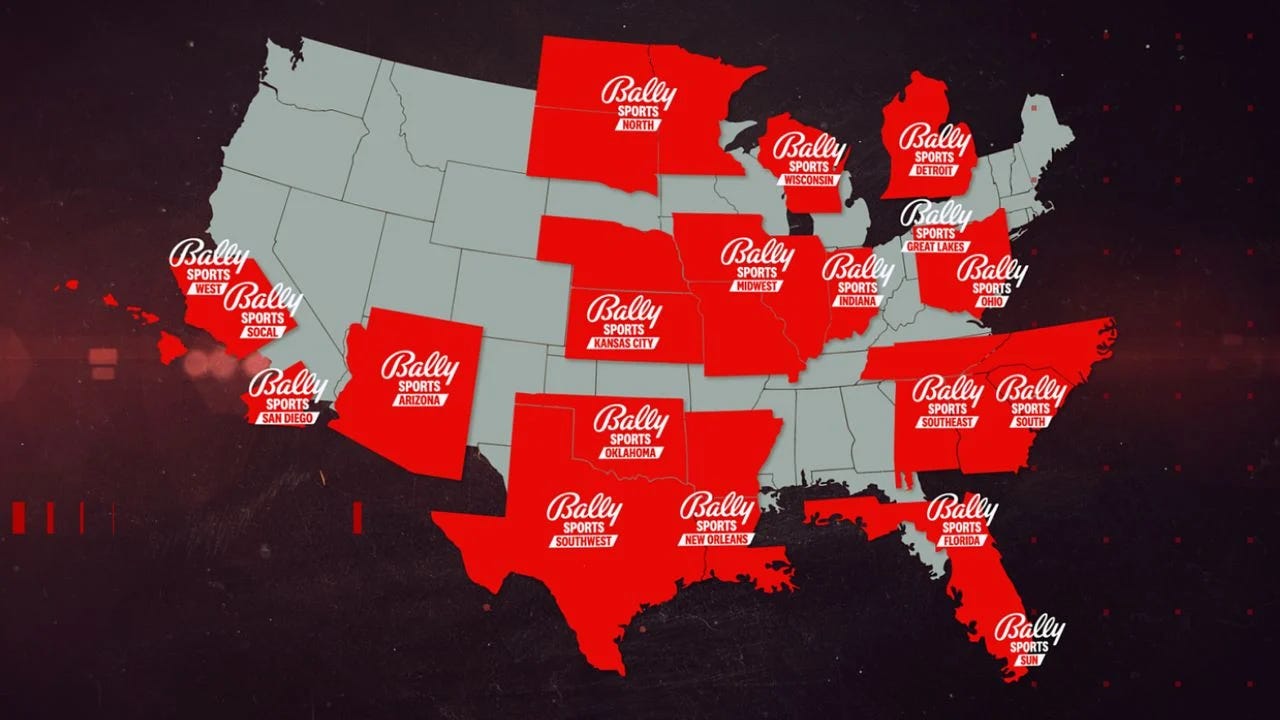

Bally Sports’ Decline

This past summer Diamond Sports Group (parent company of Bally Sports Regional Network) detailed just how rapidly the business declined.

At the time of acquisition in 2019, the RSN covered 42 NBA, NHL, and MLB teams.

Their projections over 10 months: 📉

- April 2019: $1.5 billion of cash flow

- February 2020: $1 billion cash flow

- July 2020: $750 million cash flow

Diamond Sports Group is currently in Chapter 11 bankruptcy and is suing Sinclair for “insolvent” assets.

So what will this lead to:

- teams creating their own options (YES Network, Yankees)

- leagues stepping in to take more direct control (Padres w/ MLB)

- partnering with other local market teams (Suns bought rights from Bally)

Here’s the big problem…

RSNs could once pay huge rights fees to the teams because they received fees from every cable subscriber — sports fan or not. That’s no longer the case with streaming (and the more D2C approach).

Looking at other leagues:

- The NBA and NFL are fine because global broadcasters want their rights (there’s also NFL RedZone and NBA+).

- The MLS is fine because they signed a huge deal with Apple TV.

But what about hockey, baseball, and all these new emerging sports?

RSNs may not be an option, and there’s no guarantee tech giants like Netflix, Amazon, or Apple will come in to save the day.

This is somewhat worrying…

As RSNs can be 33% or more of a team’s yearly operating revenue — this could impact valuations, player salaries, and eventually whole leagues.

Pittsburgh Sports Regional Broadcasting

The intro of today’s briefing covered some dialogue on the viewing changes of my hometown team, the Pittsburgh Pirates.

But when you dive deeper you see it’s far more complicated:

- Pirates Cable Network (1986)

- KBL Entertainment Network (1986–1995)

- Prime Sports KBL (1995–1996)

- Fox Sports Pittsburgh (1996–1999)

- Fox Sports Net Pittsburgh (1999–2004)

- FSN Pittsburgh (2004–2011)

- Root Sports Pittsburgh (2011–2017)

- AT&T SportsNet Pittsburgh (2017–2023)

- SportsNet Pittsburgh (2023-

RSNs have been a complicated business…

Here’s a passage covering all the changes to Pittsburgh’s RSN over the last few years:

In July 2019, it was reported that AT&T was looking to sell its regional sports networks to reduce debt related to its acquisition of Time Warner.

Two potential suitors included Sinclair Broadcast Group (owners of WPGH/WPNT in PGH) and NBCUniversal (parent company Comcast is the cable provider in Pittsburgh).

On October 1, 2021, AT&T SportsNet Pittsburgh, was removed from Dish Network satellite and Sling streaming TV services.

On February 24, 2023, Warner Bros. Discovery announced plans to exit the RSN business, informing the teams that it would file for Chapter 7 bankruptcy unless deals were made for them to exit or take over the channels.

On August 28, 2023, it was reported that the Penguins had reached an agreement to acquire AT&T SportsNet Pittsburgh (whose owner Fenway Sports Group runs NESN).

Despite the competing Boston Red Sox, it was announced the Pirates would participate in the network under FSG ownership and would be rebranded as SportsNet Pittsburgh.

The Pittsburgh regional network carries:

- Pirates baseball games

- Penguins hockey games

- Minor-league hockey and baseball

- Steelers documentaries & press conferences

- High-school championships and select games

- Occasional college games (Pitt, WVU, Duquesne)

Pittsburghers love their sports…🏈🏒⚾

But where are they going to watch if RSNs die out and tech giants don’t want the rights?

This paints a clearer picture as to what’s at stake.

Looking Forward

Regional Sports Networks are no longer viewer-friendly (and a dying business model).

So what does the future hold?

I believe team-owned RSNs in big markets will hold on:

- NESN in Boston

- MASN in the DMV

- Marquee in Chicago

- YES Network in New York

However, if the number of cable homes drops below 50 million in the coming years, it’s unclear if even these outlets can survive.

I’m extremely interested to see what happens to the more than 36 teams locked into rights with the bankrupt Bally Sports — and also what moves the tech giants have up their sleeves.

Historically, the sports industry always figures out a way with better innovation (and big profits).

Fragmentation + chaos breeds opportunity — time will tell who captures it.