Everyone wants in.

After spending a week in Miami at Art Basel — that is my conclusion surrounding sports.

The long outstanding question is:

“Are the addressable markets in sports large enough to generate meaningful returns”.

I believe so (but there’s still a lot of nuance to understand first).

Let’s Dive In 👇

The Push to Sports

An influx of founders are at the gates of teams, leagues, VCs, organizations, and university athletic departments wanting to be let in.

For a considerable time, sports existed within a confined space — and the tech remained archaic.

But now, tech founders have the opportunity to get in the game thanks to the merging of:

- big data

- sabermetrics

- biomechanics

- augmented reality

- artificial intelligence

- media fragmentation

- downstream expansion

These dynamics make sports the ultimate litmus test for founders.

Entrance into the space is validation that their company promises transformation to sports, media, performance, fan engagement, and beyond.

However, communicating that value proposition requires identifying broader appeal beyond athletics.

Understanding Market Sizes

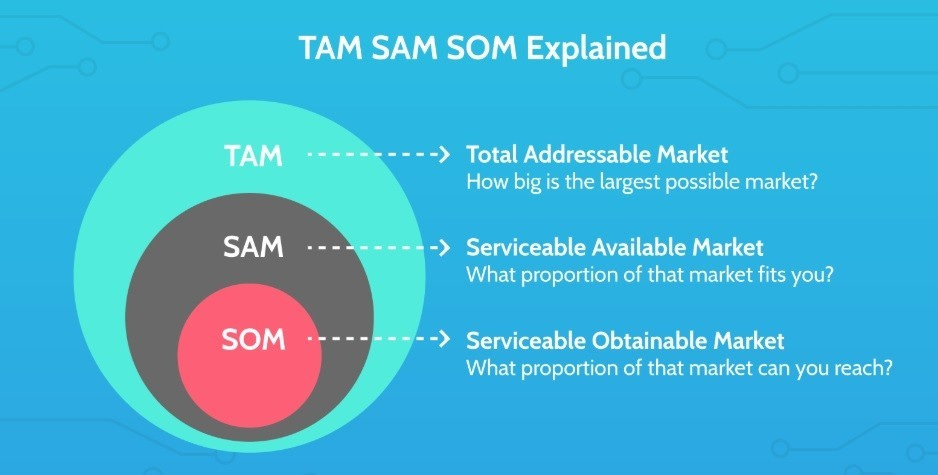

One of the first things investors look at when evaluating an opportunity is…

“How big is the market?”

While I’m only part of the investment decisions we make at Profluence Capital, I’ve come to learn exactly what our “Ivy League, Goldman Sachs, 30-year IB and PE finance professionals” look at.

The first slide they jump to is the market sizing. If you’re a founder, don’t overlook how important your calculations are for this.

Business models are in flux — at the early stages is the market big enough for it to matter?

Let’s take it a step further…

Lessons for Building in Sports

Success within sports has followed a similar playbook over the years (you either start in sports or at some point try to capture that market).

- Minute.ly sold exclusively to sports properties for several years before extending their services to other media outlets.

- Dust Identity, which just raised $40m, started authenticating memorabilia in other industries before entering sports.

Let’s look at some other examples:

- Pedialyte started promoting their drinks to help with hangovers and eventually found its way into sports locker rooms — this helped them market to consumers and dispelled the notion it was unaffordable.

- Athletic trainers once used kitchen tongs for deep muscle manipulation — now we have Theragun and HyperIce.

- Athletes embraced cryotherapy for individual recovery before its introduction to professional locker rooms, companies, and eventually the wider public.

- Load management tracking by soccer teams has been a longstanding application of the wearables industry, sparking a revolution that led tech companies such as Whoop, Garmin, and Fitbit to create devices enabling fitness enthusiasts to monitor workouts.

Sports provide a training ground for companies — but their larger marketing strategy has to extend further.

So where do you go next?

Looking Ahead

Essentially, all companies born within the sports industry begin as B2B.

Founders are selling their products, services, and technologies to teams, leagues, and rights holders — which are businesses.

I talked about this in deeper detail in “Building a Unicorn in Sports”.

Two ways to go:

- D2C offering

- remain a B2B company that grows beyond sports

Making the sports industry an “endorser” of technology to stimulate widespread adoption is a sound strategy (albeit rarely the lone route chosen).