As some of you know…

My entrance into content started around showcasing savvy athletes as businessmen and investors.

But the state of play in 2021, is far different than it is today.

There are some trends taking place worth digging deeper into.

Let’s Dive In 👇

Funds Around Athletes

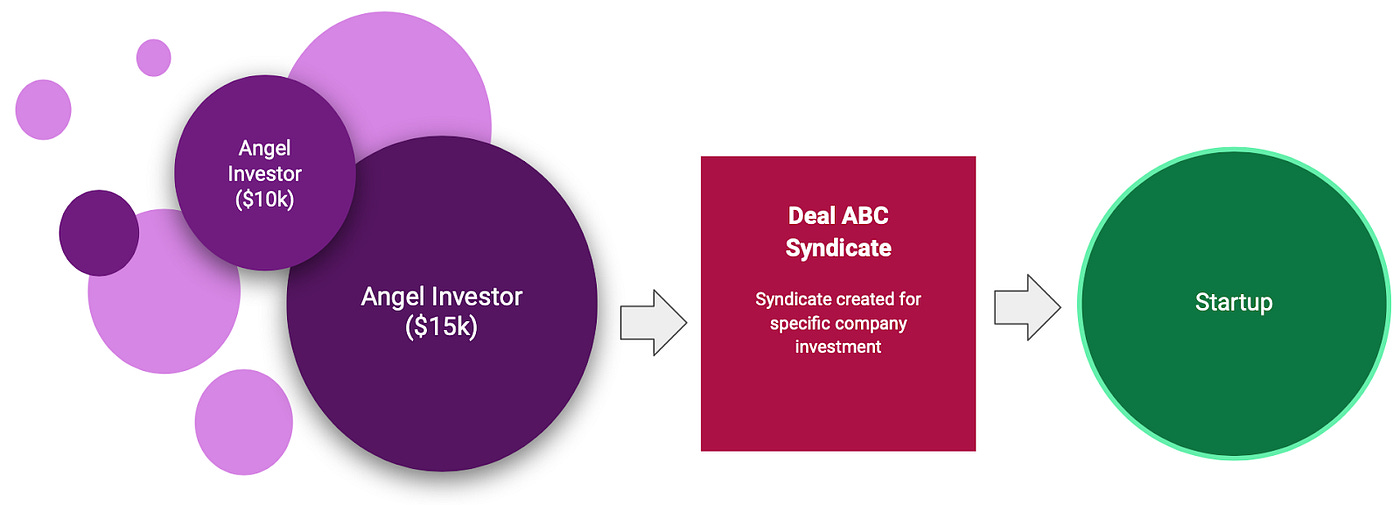

Over the years, we’ve seen syndicates bring together multiple athlete communities to a deal.

The thing is…

Syndicates aren’t that lucrative for the people doing most of the work (which can be a lot to organize):

- a small fee for bringing everyone together

- % of the profit if the company has an exit

This dynamic has pushed the people organizing syndicates into a new model which I call “Athlete Venture Funds”.

So what’s going on…

Venture funds are being raised (mostly outside of the US) around athletes.

While the websites of these funds showcase athletes and their PR announcements talk about the players involved — keep in mind they rely far more on institutional money than the actual athletes.

I’m curious to see how these funds utilize athletes at scale for portfolio companies.

What You Need To Know

The value of athletes continues to increase day by day (and increasingly on the business side of the equation).

20 years ago, athletes were assets on the field and “dumb jocks” in business.

Today, athletes are assets on the field and even greater assets in business (eyeballs, influence, networks).

It’s important that…

𝐅𝐨𝐮𝐧𝐝𝐞𝐫𝐬 𝐮𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝 𝐭𝐡𝐞 𝐝𝐢𝐟𝐟𝐞𝐫𝐞𝐧𝐜𝐞 𝐛𝐞𝐭𝐰𝐞𝐞𝐧:

• athletes that are part of a fund

• athletes together in a syndicate

• athletes with their own venture fund

• athletes as individual angel investors

𝑬𝒙𝒂𝒎𝒑𝒍𝒆𝒔 𝒇𝒐𝒓 𝒆𝒂𝒄𝒉:

• athlete-led funds (The Players Fund, APEX Capital)

• athlete syndicates (Sequel, The Players’ Impact)

• athletes w/ own fund (35V, Serena Ventures, RX3 Growth Partners)

• athletes as angel investors (Mario Götze, Kelvin Beachum Jr.)

They all have their pros and cons ─ along with distinct differences including industries they look at, stage of investment, and 𝘮𝘰𝘴𝘵 𝘪𝘮𝘱𝘰𝘳𝘵𝘢𝘯𝘵𝘭𝘺 the level of involvement of the athletes.

For example, an athlete as an angel investor can be named in press releases and will be extra incentivized to open up their resources to make sure the company succeeds.

Athletes as part of a syndicate or fund shouldn’t really be named in press releases and we’ll see what level of involvement they end up having (still a new concept).

One thing I’m seeing in the market…

An Unbalanced Market

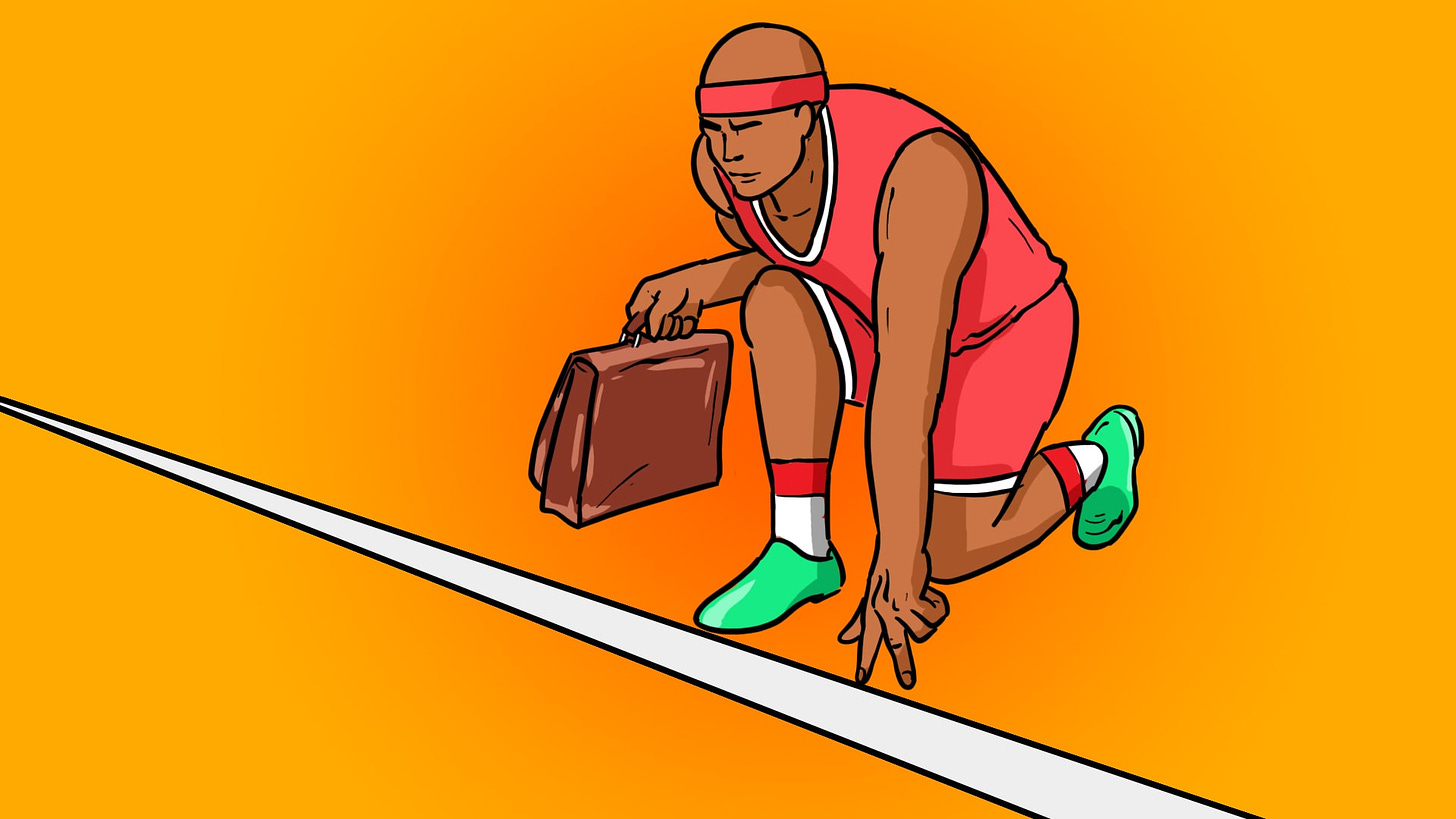

Like any market, supply and demand are everything.

Right now — there is a massive supply of “athlete investors” and “athlete funds/syndicates” but potentially a decreasing amount of demand for the value they can bring to startups.

To me, this is going to make athletes more valuable individually as investors than together as a group.

This is why sometimes I laugh when I see…

“Lebron James invests in _____” and see in that same article that “this investment was made through LRMR Ventures”.

It wasn’t Lebron investing as an angel, but his team/venture arm doing a deal and then the PR people trying to finesse the headline. Lebron may not even know about the deal and will have limited/if any involvement in helping it succeed.

On top of all this…

Some of these athletes with their own firms now have loads of investments. How much value are they truly adding?

They can’t do social posts for every company or set up intros to their network with every founder — so how much do you value the 48-hour PR push and how good is the team around these athletes?

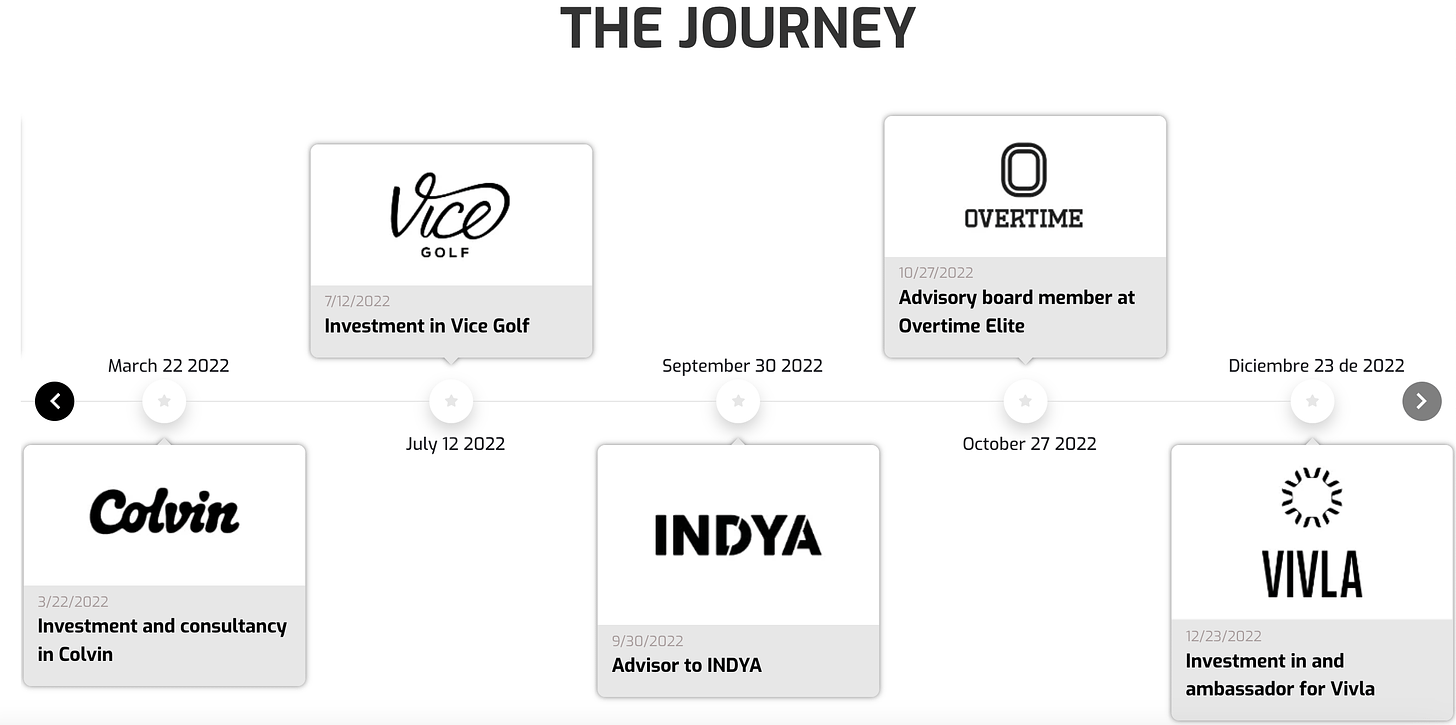

The best athlete investors are the ones who are extremely picky and follow a niche.

Pau Gasol and Gasol16 Ventures come to mind as he has a small team around him and they focus on:

- Late stage sports

- Spanish entrepreneurs

- Health, wellness, fitness

He showcases this beautifully on his website:

It’s clear what he’s passionate about, invests in, what stage, and how he will add value.

Where Is This Headed

The athlete investing space is evolving and we’re entering territory never seen before.

As I said, anytime you’re dealing with an entity you should bucket it:

- athletes that are part of a fund

- athletes together in a syndicate

- athletes with their own venture fund

- athletes as individual angel investors

All of them are completely different! It’s important to understand the dynamics so you’re aligned.

I’m rooting for many of these athlete-related investing entities to win — and am curious to see how they operate.

More sports tech investors continue to enter the industry.