Radio (founded 1895).

Sports was opened to new growth when in 1921, a live boxing match was broadcast in Pittsburgh.

Television (founded 1927).

Sports really started to pick up steam when in 1939, a baseball game between Columbia and Princeton was shown on live TV.

Streaming (founded 1990).

Sports took on new heights when in 2001, an Ohio State spring football game was live-streamed.

Social Media (founded 1997).

Let’s explore the implications we’re just now starting to see 👇

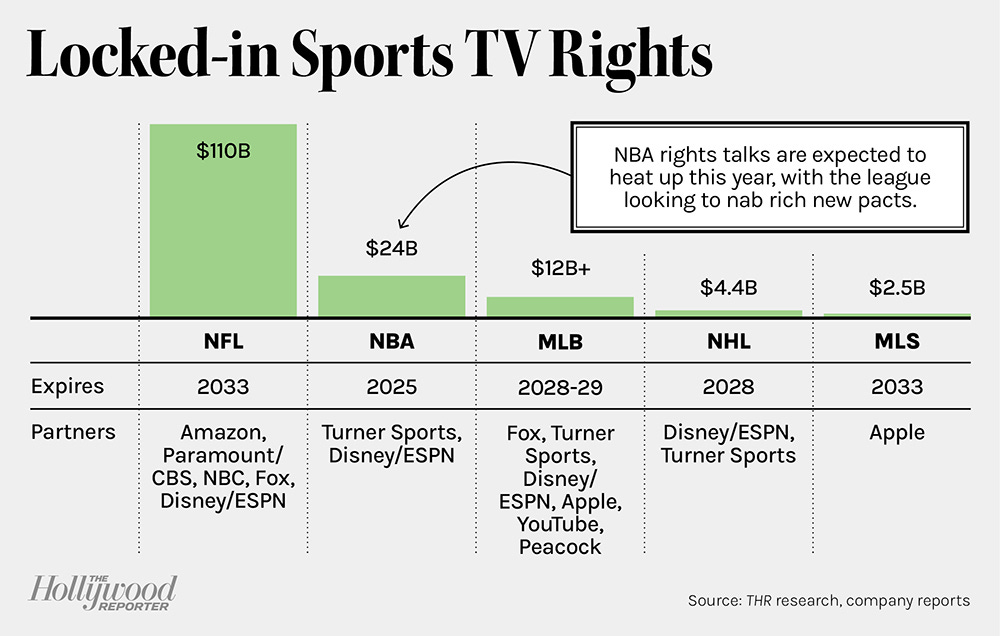

TV Contracts Go Bonkers

I think it’s important to set the stage by taking a quick look at the immense growth of revenue thanks to TV/streaming deals.

Why?

Because to get to where we are today…you need to follow the progression.

Radio → TV → Streaming → Social Media.

Everything is moving towards bringing you closer to the action and engaging you (hence the overused buzzword, fan engagement).

As we saw in the last briefing, the four major North American sports had their unions organized in the 1960s. This opened up collectively bargained TV deals.

In 1970, the networks paid:

- NFL – $50 million

- MLB – $18 million

- Pro Hoops – $2M (before NBA + ABA merger)

By 1985, the prices had increased to:

- NFL – $450 million

- MLB – $160 million

- NBA – $45 million

- NHL signed its first deal in 1994

Today…the media rights are exponentially larger!

But it’s no different globally, look at the Premier League in England ($2B/year) or the IPL in India ($1.2B/year).

TV didn’t just help sports grow — sports helped TV grow.

But Gen-Z is different!

Mixing in Content Creators

Only 23% of Generation Z said they are passionate sports fans.

Compared with 42% of millennials (defined as 26 to 41), 33% of Generation X (42 to 57), and 31% of baby boomers (57 to 76) who identified themselves as passionate.

This has led savvy sports leagues to open up new initiatives.

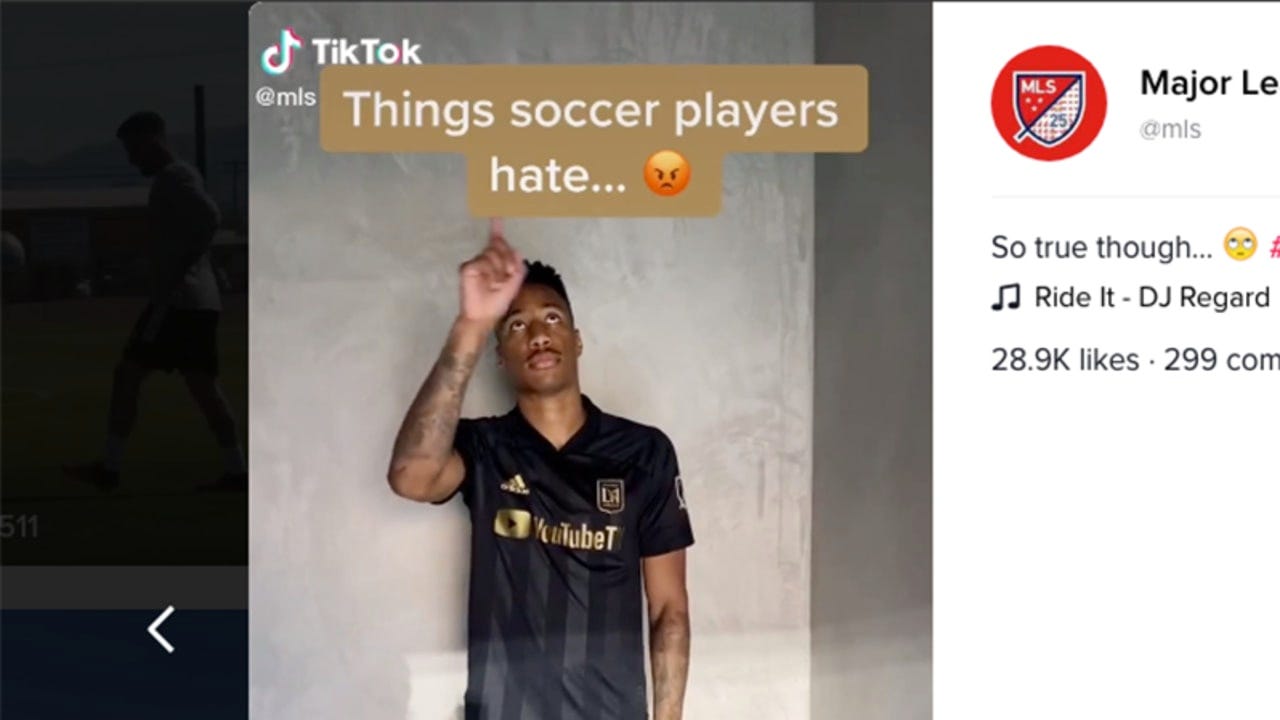

1️⃣ Major League Soccer (MLS) and TikTok entered into an “Official Partnership” where they launched a Club Creator Network.

TikTok creators are paired with MLS Clubs to create content…

What’s this supposed to do?

Enhance the fan experience by offering unique access to MLS players and behind-the-scenes moments that can only be found on TikTok.

2️⃣ The NFL opened up its Access Pass Program — enabling content creators to use officially licensed footage.

This one is interesting because in the past YouTube and the NFL would punish creators for using their content via copyright strikes.

Now they’re promoting bite-sized content in the hopes it will fuel more football-focused content that appeals to younger viewers.

3️⃣ Individual NFL teams bringing on content creators.

For its week one games, creators worked with various teams.

Katie Feeney (3.2 million subscribers) took to YouTube Shorts to upload her content from the Los Angeles Chargers game.

The Merrell Twins (6 million subs), hosted the Kansas City Chiefs tailgate party before the game and also filmed behind-the-scenes content.

And a few months ago, the NFL had over 40 content creators covering the NFL Draft.

4️⃣ Some other creator initiatives we’ve seen.

• The NBA co-founded the professional NBA 2K e-sports league and tied it to individual franchises.

• The MLB recruited influencers to produce TikTok content for the World Series under the hashtag #mlbcreatorclass.

• Adobe partnered with the NWSL to help soccer players learn how to produce better content.

Social Media and Sports Mix Well

The strategies above make a lot of sense…

Especially when you realize the influencer and content creator industry is expected to grow to an estimated $20 billion by the end of 2023.

Consider sports fans’ current social media use patterns:

- 41% of global sports fans stream live sports through digital platforms.

- 58% of 16-to-24-year-olds report following athletes on social media.

- 32% of sports fans (43% of Gen Z) use social media platforms while watching live sports.

In terms of creators, the most active and followed sports accounts are still traditional publications.

Here’s a breakdown of those with the most activity and resulting Earned Media Value (EMV) from last year:

- ESPN: 848 posts – $35.9m EMV

- Bleacher Report: 512 posts – $23.2m EMV

- Sports Center: 193 posts – $16.6m EMV

- House of Highlights: 171 posts – $9.1m EMV

- NBA TV: 150 posts – $5.9m EMV

Speed in which who leveraged content creators the best:

Startups → Niche Media → Traditional Media → Teams → Leagues.

Where’s This Headed?

I believe the next great broadcasters, film producers, and sports league spokespersons will arise from social media.

Your resume is becoming less about who your parents know and an over-inflated liberal arts degree…

And more about showcasing your skills, talents, work effort, and passion via the digital world.

Creators play a key role in marketing, driving revenue, and enhancing the overall entertainment value within sports.

Exciting times are ahead! Especially as creators help build alternative emerging leagues.