In just the last month, we’ve seen billions of dollars raised for investment funds targeting opportunities in sports.

But where the hell is all of this money going to be deployed?

It’s one thing to raise a fund — it’s another to invest it back into the ecosystem.

Today, I’ll break down where I see the money flowing.

But first, let’s take a look at who raised funds.👇

Big Money in Sports

All of this has happened in the last month.

- DICK’s Sporting Goods launched a $50M in-house investment fund, DSG Ventures, to invest in the future of sport and retail.

- Eli Manning’s PE firm launched a sports-focused vertical, Brand Velocity Group Sports (BVGS).

- The NBA created NBA equity, a private equity division to invest in startups.

- Will Ventures raised $150 million for Fund II, they will continue to invest in seed-stage companies in the consumer, health, sports, and entertainment sectors.

- The Minnesota Twins, in partnership with TechStars, announced 10 startups for their 2nd ever accelerator.

- Velocity Capital Management said they will invest up to $50M in sports, media, and entertainment companies.

- Lionel Messi announced the launch of his new venture firm, Play Time, alongside experienced venture capitalist Razmig Hovaghimian.

- Next Play Capital, started by former Super Bowl champion Ryan Nece, raised a $200M fund.

Yep.

That’s a lot of big-time names, entities, and cash ready to get off the sidelines and “into the game” throughout sports.

Each fund will have different strategies, niches, check sizes, and stages of investment.

And I’m sure you’re wondering…

Isn’t the market bad? Isn’t a recession coming? Isn’t now a terrible time to invest?

Well…

Follow The Smart Money

If you only take away one thing from this entire briefing — make it this:

“Be fearful when others are greedy and greedy when others are fearful.” – Warren Buffett

So why do I bring this up?

When the market is crashing — fear sentiment is high. When the market rises — greed dominates.

I think we all know where the market is currently at…

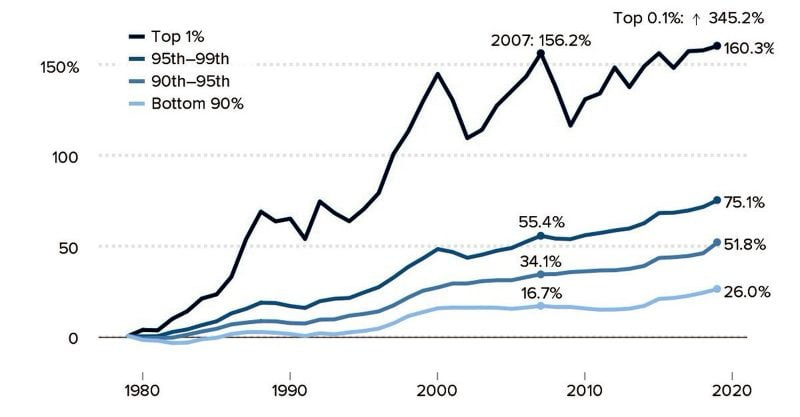

But this is the classic example of why the “rich get richer”.

A bad economy creates amazing opportunities (and it also separates the contenders from the pretenders).

So while everyone else is running away, look at all the smart people/funds/organizations that are ready to deploy crazy amounts of cash into the ecosystem.

They’ll be getting the deals of a lifetime by investing in companies that survived a bad economy and will flourish as it recovers.

Some of these companies will IPO, which is when all of these funds will sell for massive gains and retail investors will gladly buy the top as greed sets in.

Anyway…

Let’s take a look at where some of that money could be going:

Where Sports Money is Headed

Honestly, I have no idea what any of these funds actually plan to do.

But…

I can make some good assumptions based on their past moves, my research, conversations, and where the future of sports is headed.

Let the fun begin 👇

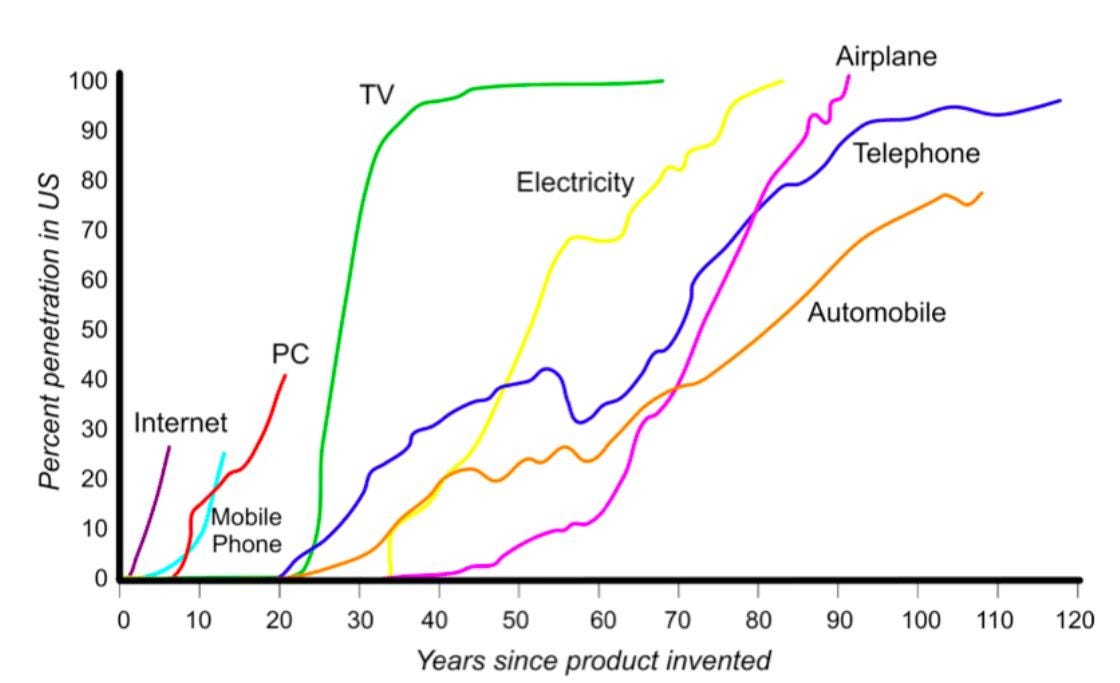

Web3

We’re still in the early innings of web3 technologies.

The hot wave of 2021 and “blind funding” is over. The bottom is almost in.

The companies building tech with real-world utility are grinding hard behind the scenes.

Things take time to adopt — the third version of the internet is no different.

The top startups will attract funding as they show traction and as the macro-economy recovers.

AI

Artificial Intelligence/Machine Learning is a hot market right now.

Lots of sports technologies rely on them and will continue to in the future.

I see money headed towards these companies, especially ones where AI helps with data analytics/collection/monetization.

India

I wrote about the emergence of India a few months ago and still think it has MASSIVE potential.

Several readers who are in the VC world have told me they have boots on the ground searching for these opportunities as of today.

Some European + American sports companies are already starting to devote resources to the space — Pixellot recently showed off its AI cameras at a sport tech event in New Delhi.

NIL

The most successful name, image, and likeness (NIL) companies were around before it went live in college. Most of them don’t need new funding.

However, many of the new entrants are reaching 18 months of operations.

If they can show product-market fit, steady growth, and a brighter future — capital will be available for them.

Esports

Gaming and esports aren’t going anywhere.

Kids who grew up playing video games will play them into adulthood, and you better believe their kids will participate in the virtual world as well.

Call of Duty’s new game reportedly earned over $1B in sales during its first two weeks of availability (smashing the previous record).

Teams

I expect to see alternative sports continue to garner attention.

Along with traditional sports (it’s looking like Jeff Bezos and JayZ might buy the Washington Commanders).

Pickleball has been hot of late, but there are many other potential investments.

As alternative leagues gain traction, they’ll become targets for investment or private equity buyouts.

Media and Entertainment

Most of the new funds entering sports also invest in media + entertainment companies.

This allows them to stay pretty broad.

It also shows how important content, eyeballs, and attention are.

I hate the phrase “all companies are media companies”, but in sports, this is more true than in most other industries.

- Not every company needs to create highly-produced video content.

- Not every founder needs to be the face of their brand.

But if you’re in sports and monetize in any way B2C, eyeballs are important.

Women’s Sports

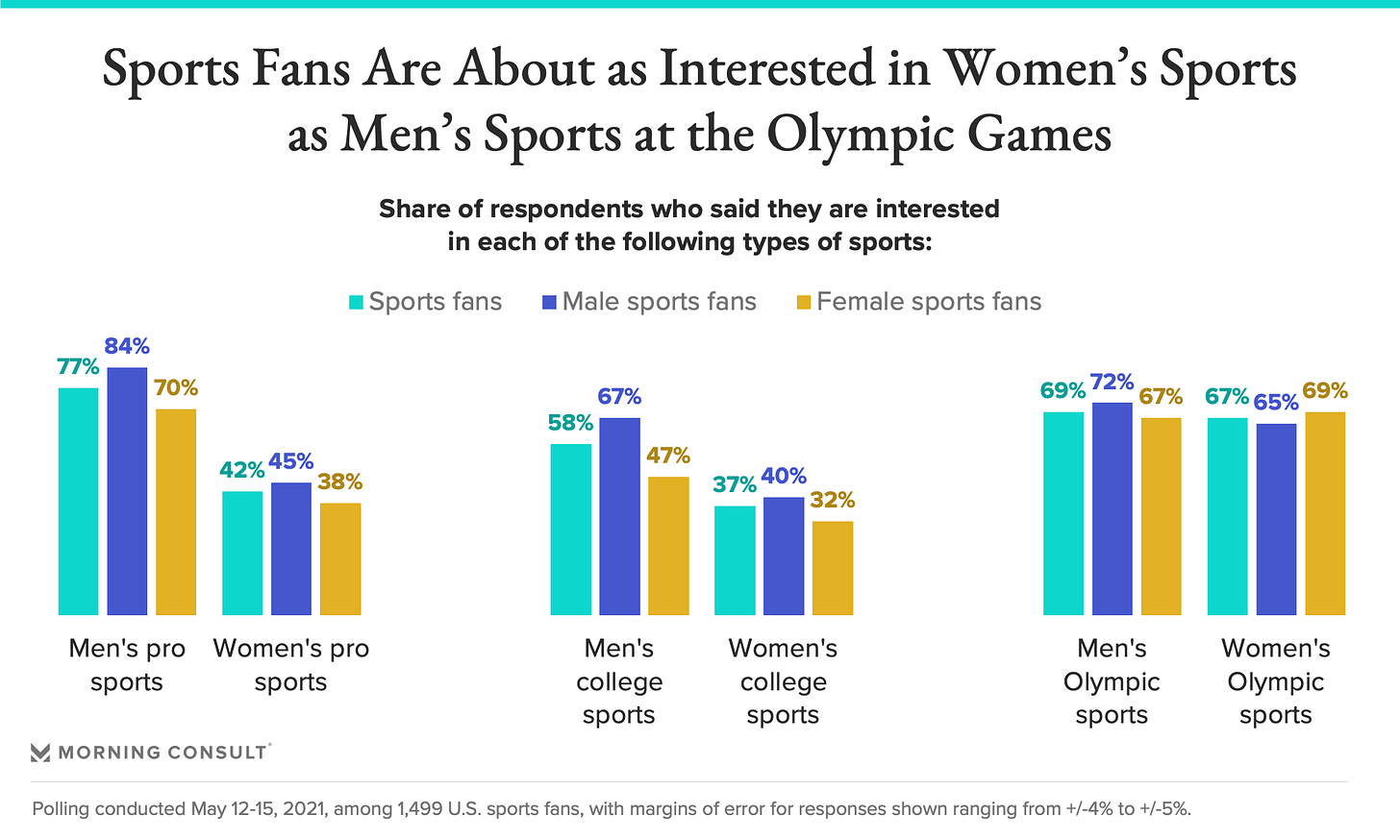

There’s definitely been a push to help grow women’s sports over the last few years — and it’s starting to work.

Team sports like soccer and basketball have seen a lot of this upside, but sports like volleyball, softball, and lacrosse are sure to see more.

The thing is…

Women’s sports can’t follow the same strategies as men’s sports and expect to grow.

The leagues that get creative will earn funding, sponsorships, and top talent (athletes, employees, advisors, etc).

Looking Ahead

As I mentioned before, all of this is speculation based on my research, prior articles, conversations, and predictions for the future.

Nonetheless, there’s a lot of money ready to be deployed across sports.

Innovative companies will have their chance to shine (and shine bright).

With all this increased funding, startups need to be strategic with who they take money from as well.

Not all investment cash is equal.

(read that again ^^^)

Startups need to do their research before pitching potential investors.

You want to make sure they don’t have competitors in their portfolio and are experts in your niche to help accelerate growth beyond just capital.

Sports are about to undergo a massive technological haul.

I’m excited about it, are you?