Tracxn recently launched its sports tech report (and DrakeStar allowed me to highlight some of theirs before it comes out next week)…

I spent hours dissecting them so you don’t have to.

If there’s anything I’ve come to learn in sports…

There are contenders, but there are also a lot of pretenders.

Let’s Dive In 👇

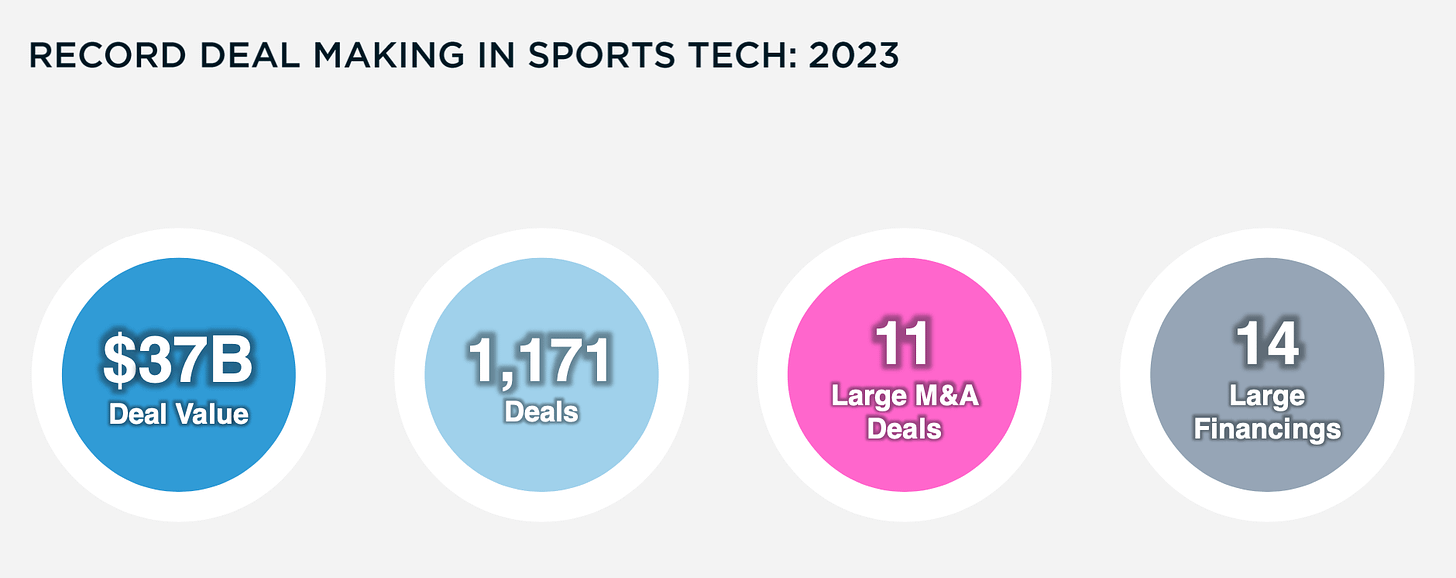

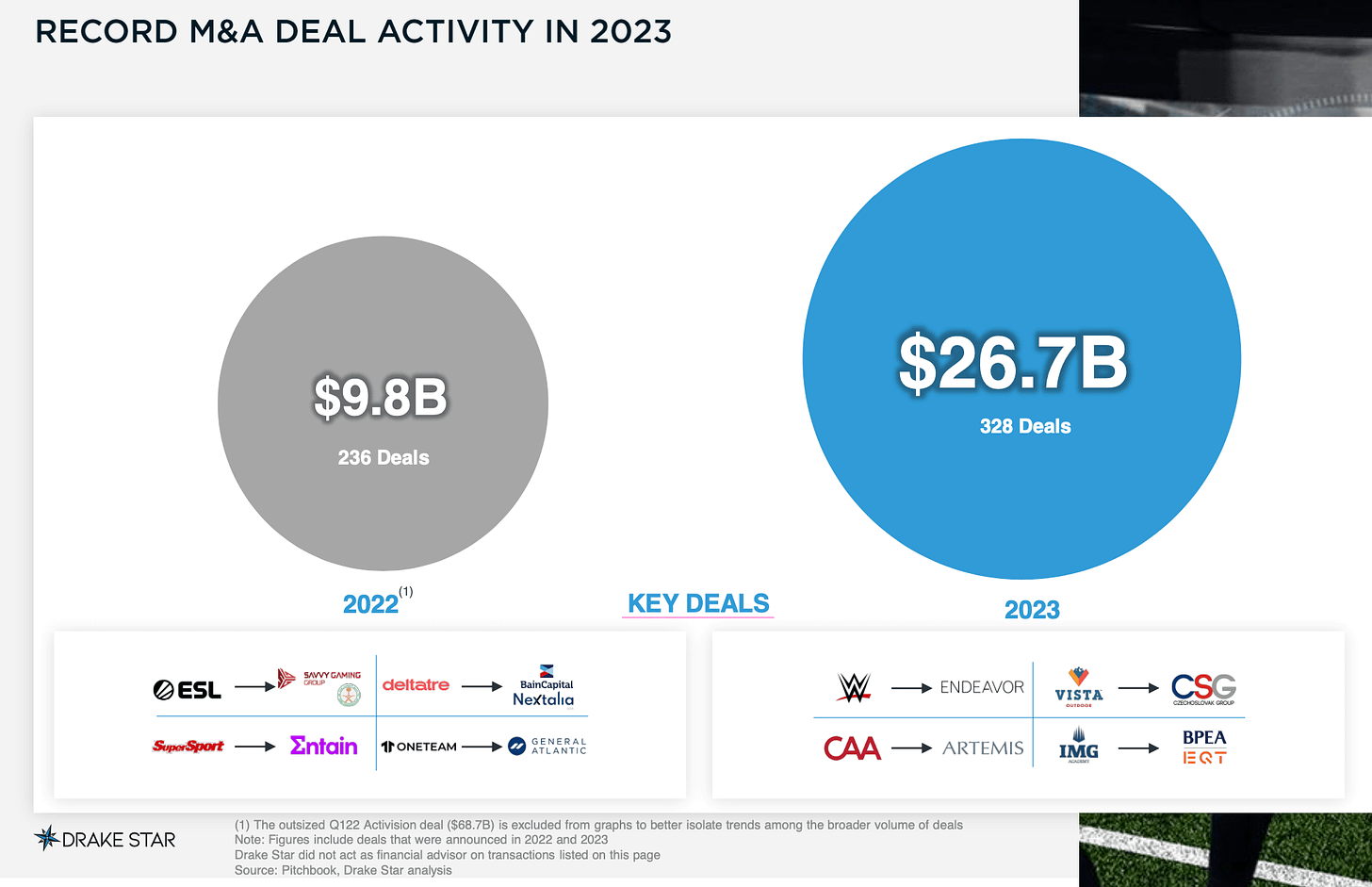

Deal Making

We saw records in total M&A and the number of deals last year.

2023 also saw some high-profile IPOs:

- Keen — China’s most popular fitness app

- Amer Sports — parent company of Salomon, Wilson, and Arc’teryx

- Lottomatica Group — first Italian operator in the legal gaming market

The overall IPO market isn’t looking great…but there are some potential contenders for 2024 in sports.

It was a record year for sports tech with announced deal value surpassing 2022 (by a margin of over $16B).

Some additional stats:

- M&A activity increased almost 3x over 2022.

- Media & Broadcasting segment saw the largest deal activity.

- Wearables & Performance Enhancement reported a significant increase of over 2x in deal activity over 2022.

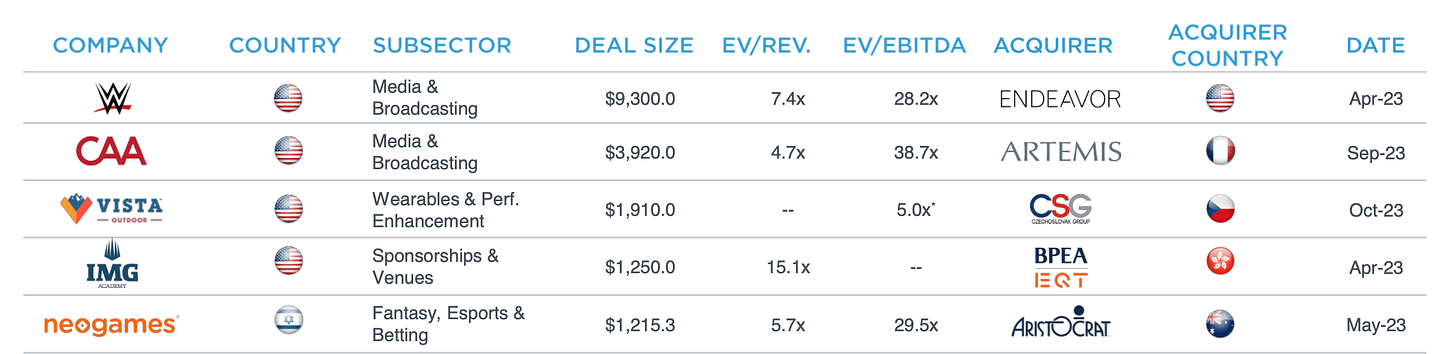

There were also some huge acquisitions (the top 5 largest were all over $1 billion):

It feels as if 2024 will have a hard time matching last year’s numbers…but in this climate…who knows?

DraftKings did just purchase Jackpocket for $750m.

Buyer Scene

When looking at potential buyers…

I think we are going to see more valid entrants over the next few years.

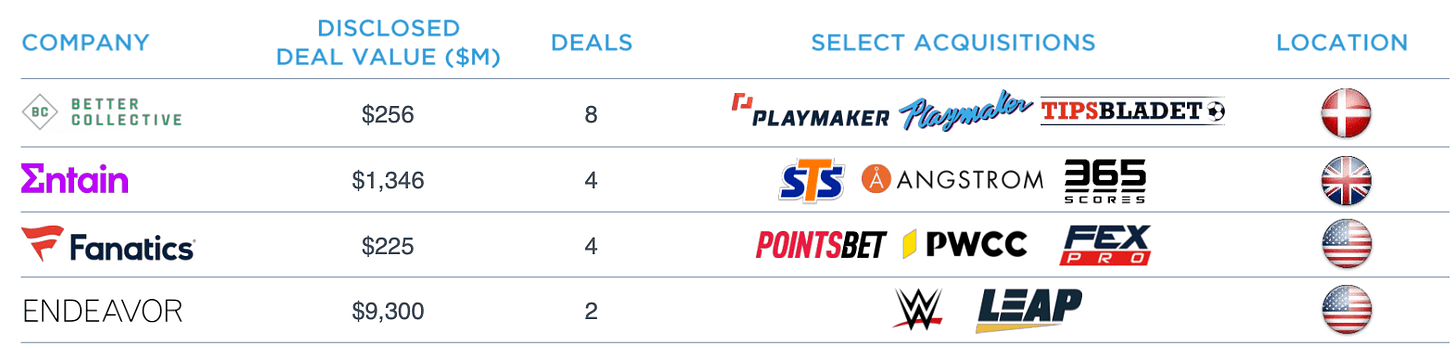

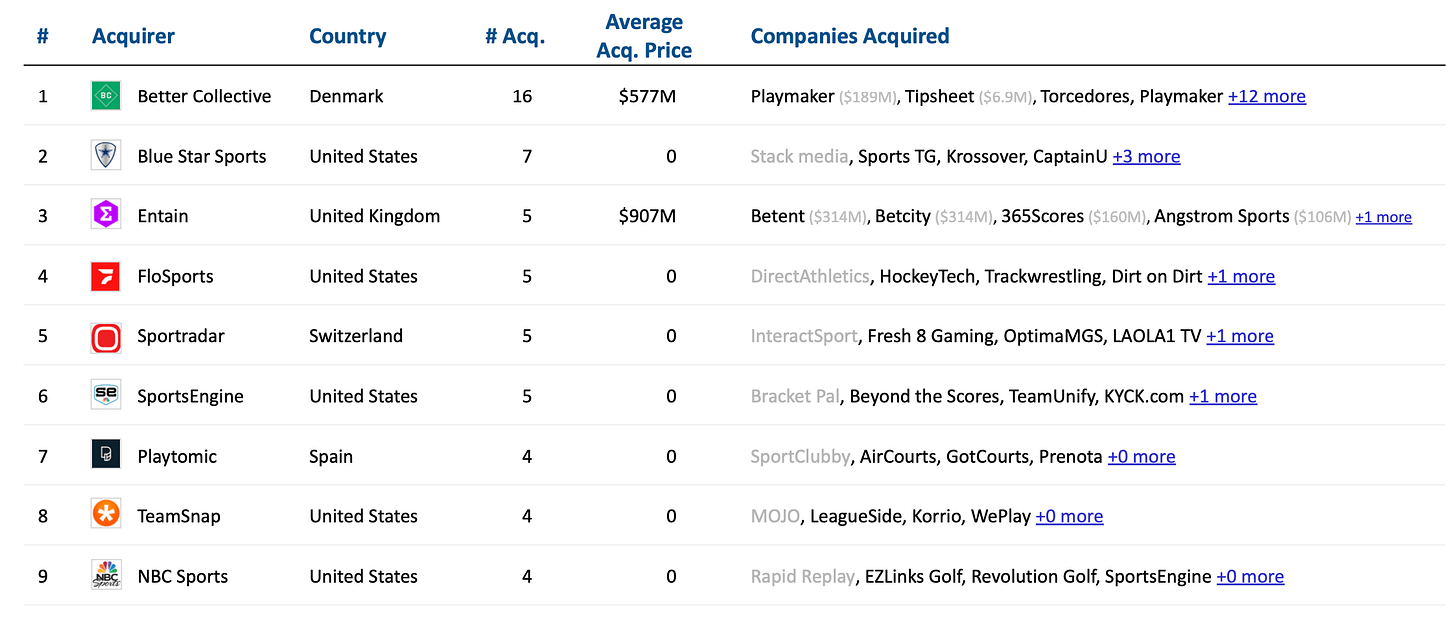

Here were the top acquirers for 2023 by the number of deals completed:

As you can see — adding sports betting and media properties were the main targets.

2024 will most likely see more of this.

Something that has disappointed me is the announcements of major private equity funds that are still yet to complete any deals.

That alone accounts for billions the market thought was going to be available — more on the state of sports investing in next week’s briefing.

Sports Tech

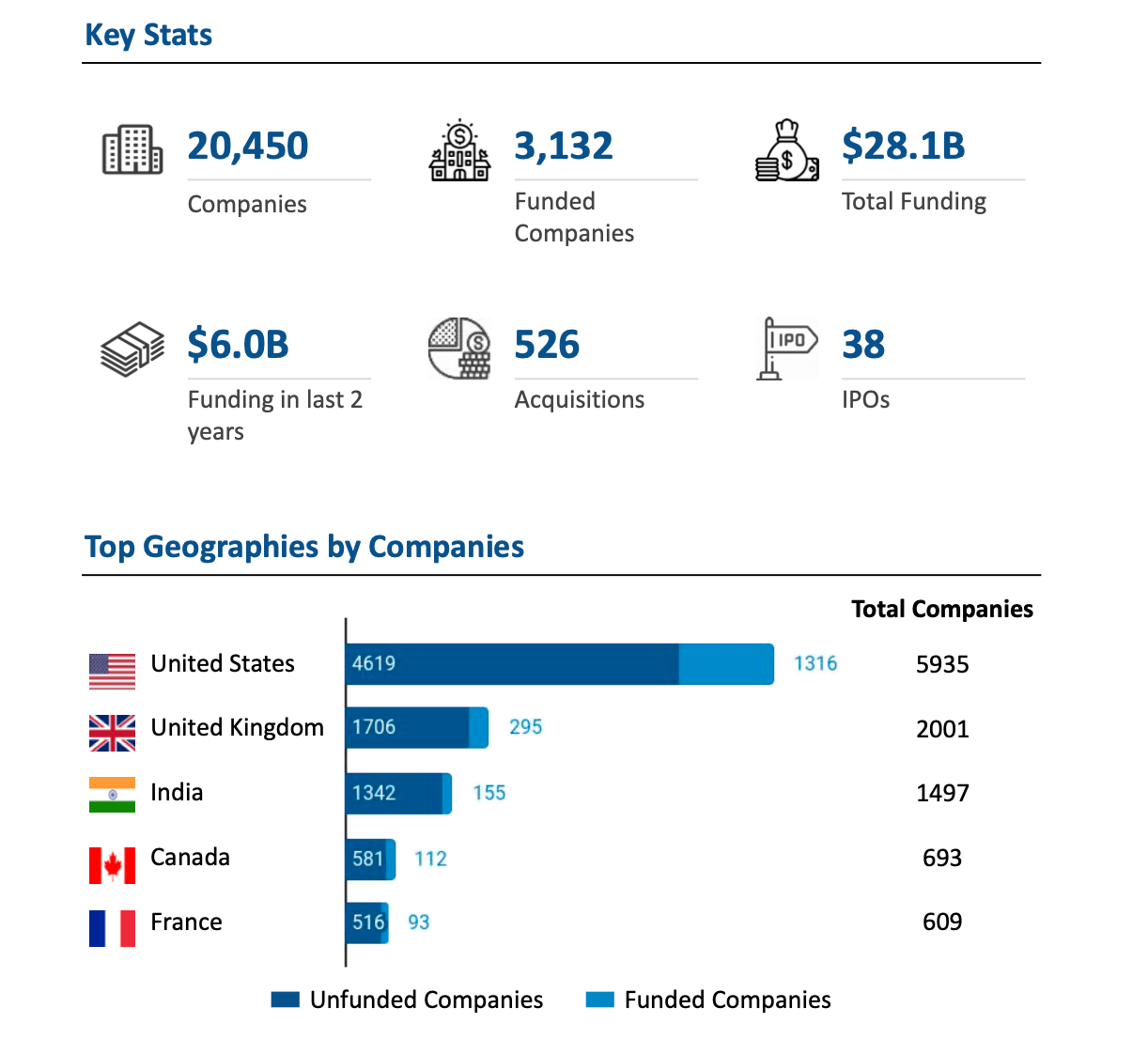

Tracxn has some interesting data that has internally sparked a lot of debate.

They have over 20,000 sports companies listed (with roughly ~15% of them funded).

At first glance, I thought 20,000 sports companies was too high of a number…

But then I remembered there are more than 150 million startups worldwide (according to Microsoft).

Acquisition Stats

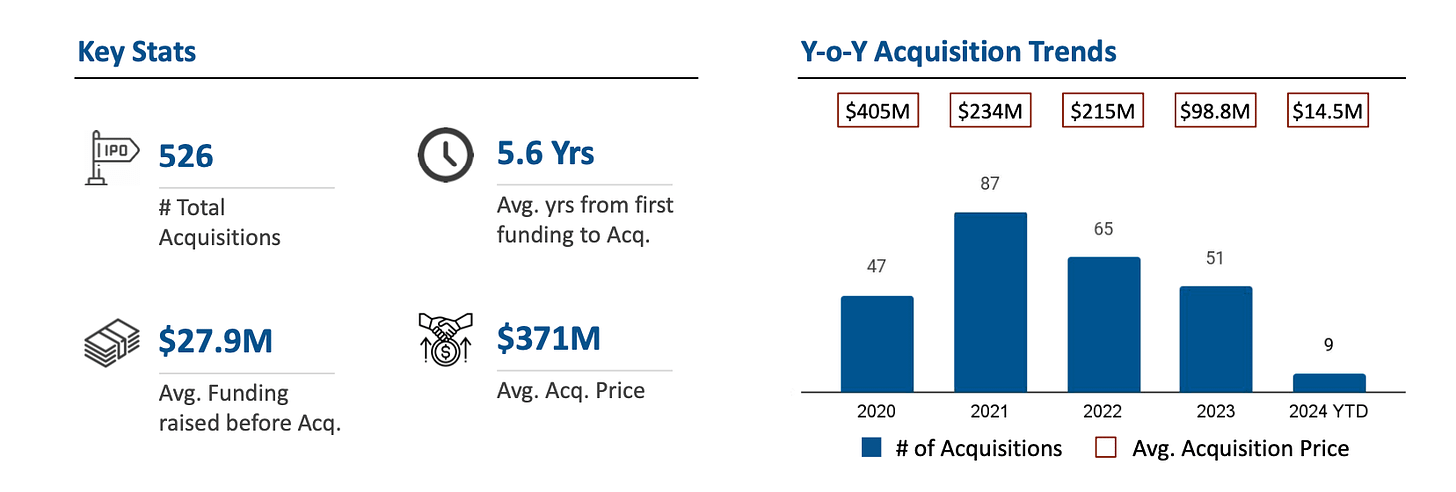

I found this section that includes time to acquisition and average price both interesting and encouraging.

Although I still question some of these numbers (as 2023 looks too low).

While you should build for scale, it never hurts to know who could be a ‘good’ potential acquirer of your startup.

This gives a solid sample of potential acquirers but is over an extended time frame.

I imagine we’ll see more entrants here as the race heats up (especially in the betting and media sectors).

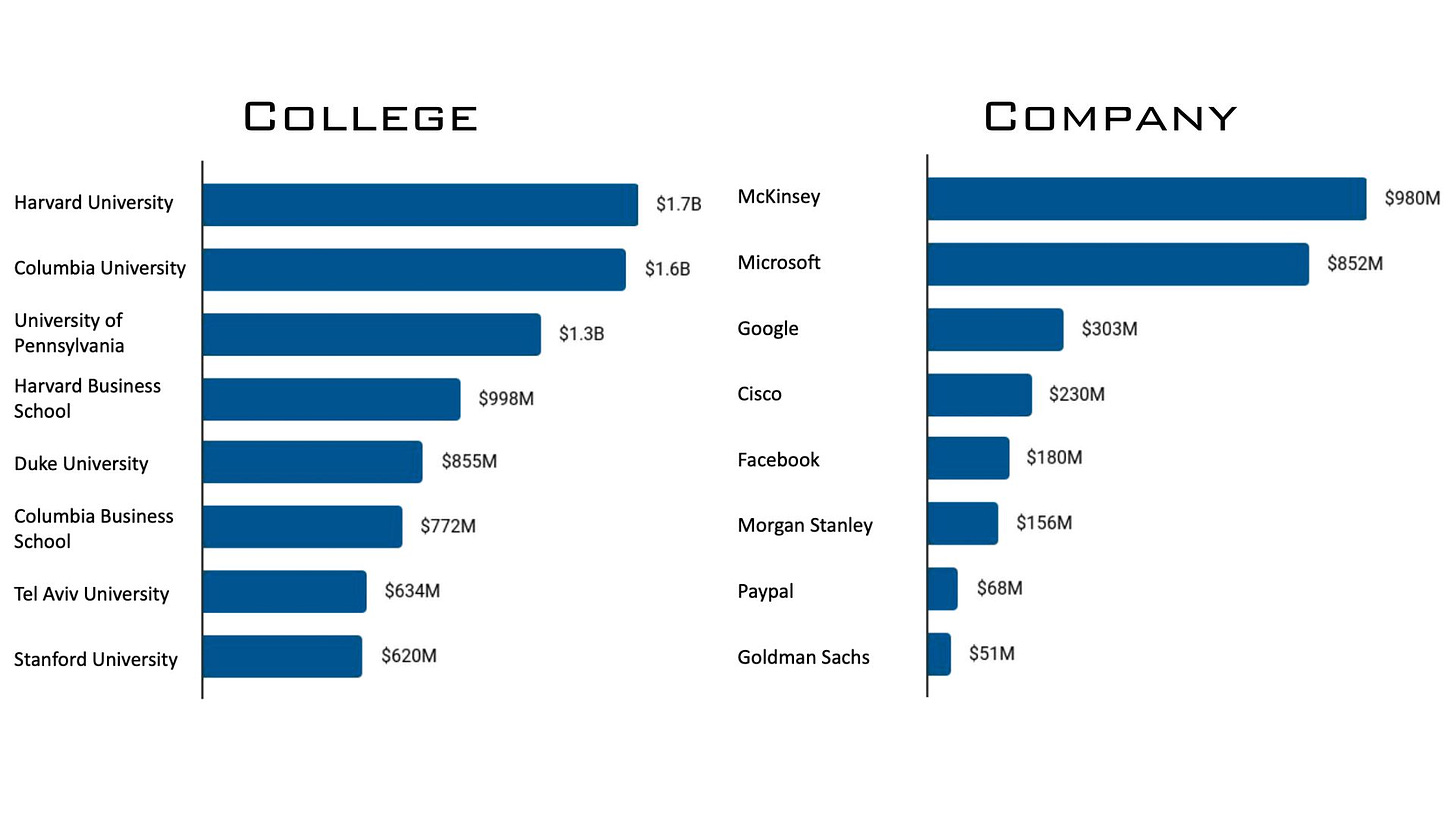

Tracxn also provided a unique look at what colleges/companies’ founding team members of sports companies attended/worked at previously.

I can’t validate these numbers — but it seems to check out (and hold some merit).