You’ve probably heard the term “family office” before and that makes sense considering…

40% of family offices have been created in the past decade.

The thing is — most people don’t know what family offices are and what they do…

And these ultra-high-net-worth families are garnering a passion for sports.

Let’s Dive In 👇

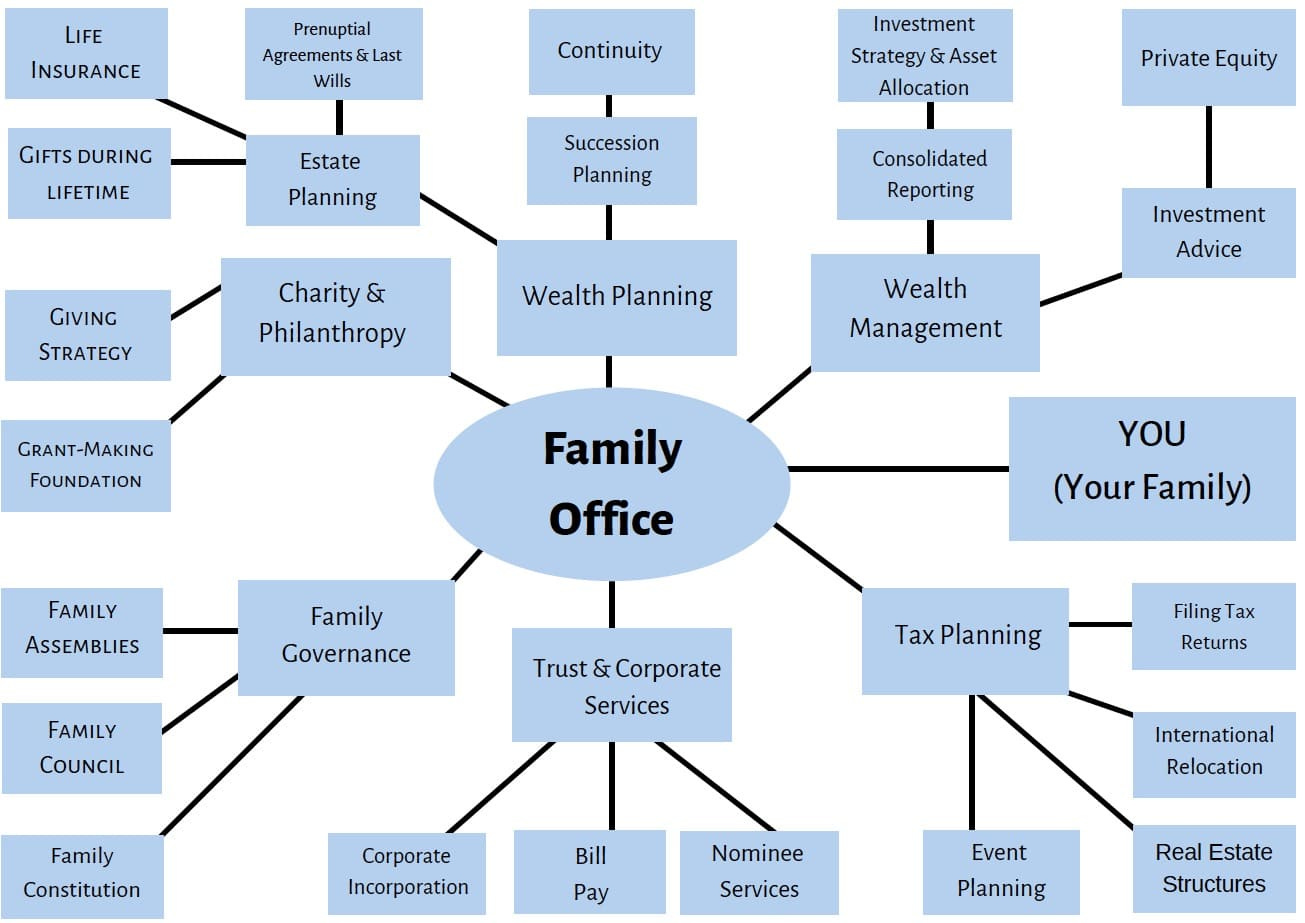

What’s a Family Office?

Family offices are private companies for ultra-high-net-worth individuals (UHNWI) whose employees help manage a family’s assets, needs, and wishes.

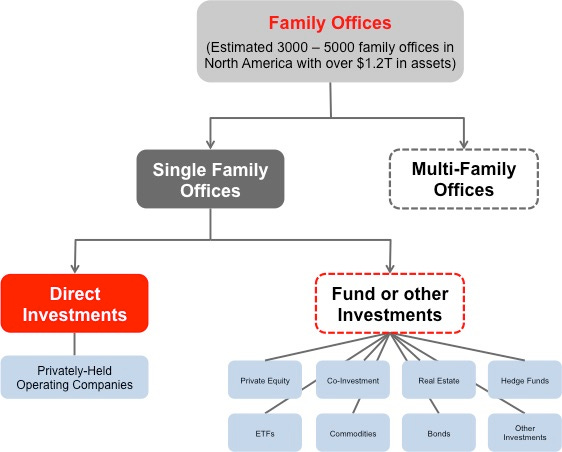

- A single-family office is a privately controlled staff employed within or outside a dedicated structure that supports an affluent family with the organization, management, and maintenance.

- A multi-family office is the same, except that it is a commercially operated organization that supports several affluent families.

The first American family offices were created in the 1880s by the Rockefeller’s and Vanderbilt’s.

Most family offices have $250M+ in assets.

The main goals of a family office:

- grow the assets

- estate planning

- wealth transfer

- philanthropy

Historically, family offices operated discreetly, shielding the wealth of affluent families from the public eye.

That is changing quickly…

As private equity disrupted the public markets in the 1980s — financial advisors say family offices will disrupt the private markets over the next several years.

The Boom of Family Offices

Here are some stats demonstrating the growth of family offices:

- Family Office Population: 10,000 single-family offices (SFOs) and 5,000 multi-family offices (MFOs) worldwide.

- Wealth Managed: $10 trillion in assets.

- Growth Rate: The number of family offices nearly doubled between 2008 and 2018.

- Asia-Pacific Region: 44% growth between 2017 and 2019.

- Wealth Transfer: $84 trillion will get transferred from baby boomers to the next generation — the largest wealth transfer in history.

- Investment Strategies: 60% of family offices have increased their exposure to private equity and venture capital.

Investment Strategy

Wealthy families own many kinds of assets:

- cash

- equities

- real estate

- fixed income

- alternative assets

Traditionally family offices focused on passive investing — but we are now seeing a more proactive and direct approach.

This is evidenced by the growing trend of alternative investments, co-investments, and venture capital participation.

Family office staff like to work with outside investment experts to develop a well-balanced investment policy across different asset classes.

A handful of athletes are starting to create family offices as well (Lebron James, Serena Williams, Lionel Messi, etc).

Stats show that 68% of family offices have allocated funds to venture capital, reflecting a keen interest in fostering innovation and contributing to the entrepreneurial ecosystem.

And family offices are starting to gain a keen interest in sports…

Family Offices in Sports

Professional sports are becoming more democratized.

Historically, it wasn’t easy to invest in sports — but there are increasing opportunities.

- ability to buy minority stakes

- options to sell assets as they mature

- emerging leagues with promising economic upside

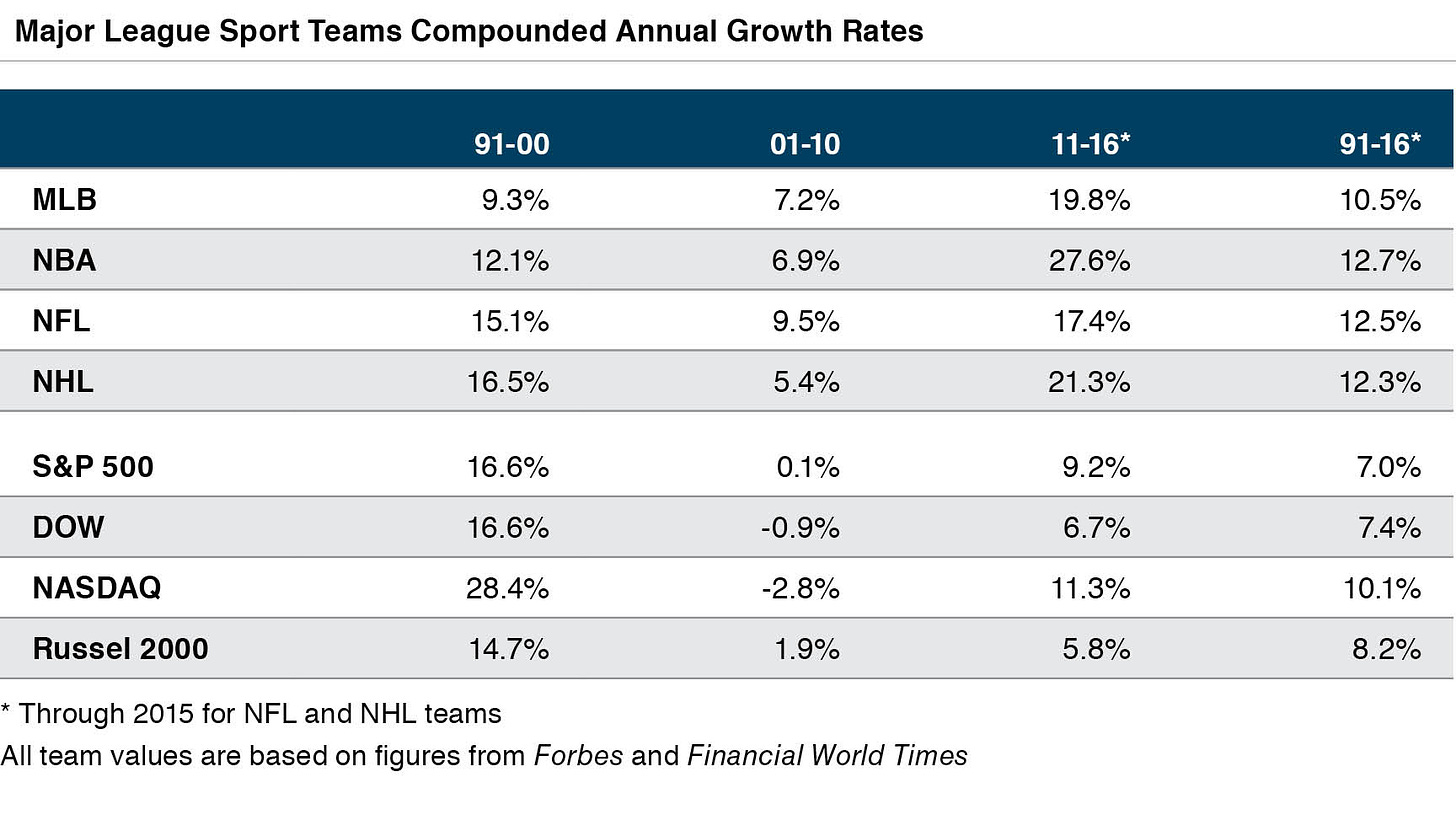

Being involved with sports assets gives families a tangibility that other investments don’t have (and the historical returns are impressive).

You have to treat sports like any other investment though — it’s not just a trophy asset class.

When you do that you can create sustainability, which comes via multiple revenue streams and increasing opportunities:

- teams

- media

- events

- leagues

- software

- hardware

- facilities/stadiums

- and many other verticals

What’s cool about sports…is that it continues to stretch into other categories as innovation improves (drastically increasing the TAM).

Looking Ahead

I was speaking with a prominent individual in youth sports, and he said that taking family office money for their startup created more problems than benefits as there was no speed.

*Family offices are often referred to as “patient capital” because there are no timetables for returning money.

Whereas taking private equity money helped the company go from $10M to $250M in revenue in a few years (along with a massive exit).

As family offices become more interested in sports as an asset class — deploying capital to investment experts through VC and PE seems to be a sound strategy.

Sports are innovating fast, the assets require a nuanced understanding, and those who are nimble with ears to the ground will drive the greatest returns.

Exciting times are ahead!